The Bank of England asked banks on Monday how ready they are for zero or negative interest rates, following up its announcement last month that it was considering how to take rates below zero if necessary. Other central banks have pushed rates into negative territory in an attempt to spur banks to lend more, and the BoE said in September it was looking into what such a policy might mean in Britain.

“As part of this work, we are requesting specific information about your firm’s current readiness to deal with a zero Bank Rate, a negative Bank Rate, or a tiered system of reserves remuneration – and the steps that you would need to take to prepare for the implementation of these,” Deputy BoE Governor Sam Woods said in a letter to banks. The BoE and lenders had to understand the implications of any such moves “since the MPC may see fit to choose various options based on the situation at the time,” he said, referring to the central bank’s Monetary Policy Committee.

Woods said he wanted to know if there were any technology challenges to implementing zero or negative rates. The BoE set a deadline of Nov. 12 – a week after its next monetary policy announcement – for banks to respond. Money markets last week pushed back bets that the BoE would cut rates below zero. Investors see rates falling below zero in May 2021, instead of March.

The BoE cut its benchmark rate to record low of 0.1% in March to help the economy through the coronavirus crisis. Sterling and British government bonds were little changed in early trade on Monday.

Banks earn money from interest and negative rates would hit profitability, but Wood’s letter made no specific mention of this, focusing instead on the technical preparedness of lenders.

Banks are already under pressure to help households and businesses struggling with the pandemic. They also could face a reduction in access to markets in the European Union when Britain’s post-Brexit transition period expires.

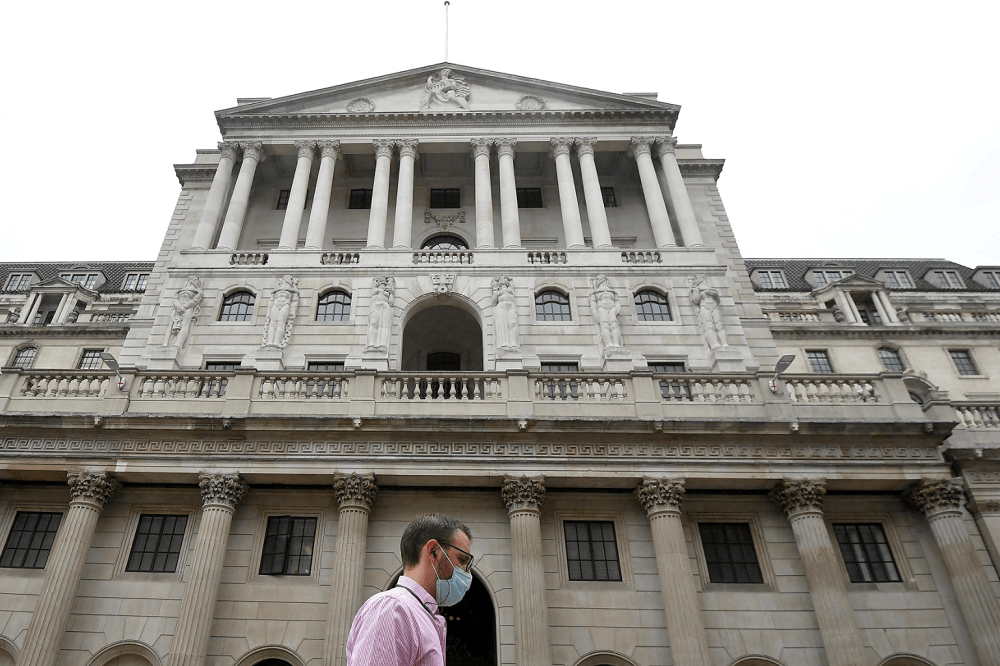

Bank of England asks banks how ready they are for sub-zero rates, Reuters, Oct 12