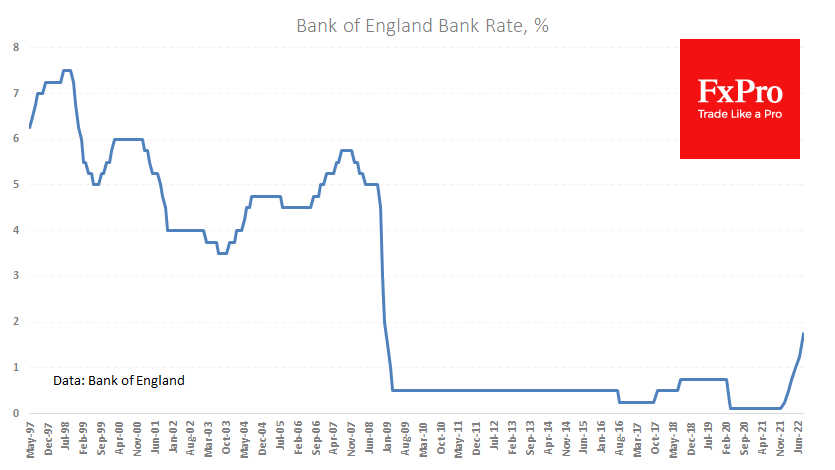

The Bank of England unanimously raised the rate by 50 points to 1.75%, which was widely expected by markets. In addition, the BoE announced that it would start quantitative tightening after the September meeting by selling assets off the balance sheet at 10 billion pounds a month.

Before that, the central bank had raised the rate five times since December in increments of up to 25 points. However, the higher pace of rate hikes has failed to inspire pound buyers for long for several reasons.

Firstly, mention must be made of the new increase in inflation forecasts. The expected peak in inflation is now forecast to be near 13% compared to 10% previously. This revision means more pressure on the purchasing power of the British currency as the Bank of England has so far failed to close the gap between the key rate and inflation, with the economy losing growth momentum.

Secondly, the pace of rate hikes in the UK is hardly surprising as the Bank of Canada raised its rate by 100 points last time, and the Fed raised its rate by 75 points twice. The market reaction to the Bank of England has confirmed the GBPUSD’s decline, which is now on its third consecutive day. The situation reminds us that the pair’s rise in the second half of July was a corrective respite. And there are growing signs that it is coming to an end

The FxPro Analyst Team