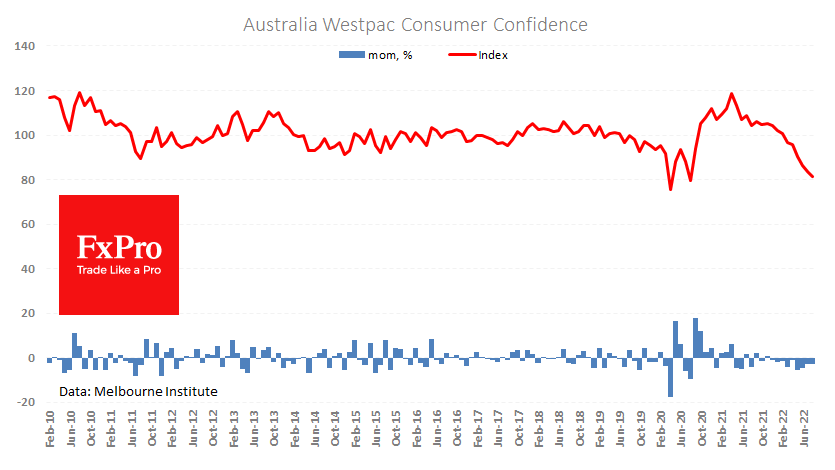

Australia’s Westpac Consumer Confidence Index lost 3% in August, developing a nine-month slump that took off 22.9%.

The index was near current levels twice in 2020 during the worst periods of lockdowns and uncertainty and even earlier in 2008 during the worst financial crisis. But current levels are well above the recessionary periods of the late 1980s and early 1990s.

However, this does not promise a bleak future for the economy as it will shift the government’s and RBA’s focus from fighting inflation to supporting demand.

On forex, the AUDUSD has been languishing around its 50-day moving average for the last two and a half weeks. At the beginning of August, it hit a glass ceiling at 0.7000, separating the crisis from the norm for the Australian economy for years.

The inability of the bulls to push the pair higher may be seen as a structural weakness of the buyers, passed on the sight of the sharp decline in the prices of metals, an important export commodity. In this case, the AUDUSD may fall without significant headwinds to 0.6700, the low of July. If there is insufficient demand, the road to the abyss opens, and the pair will move into a channel at 0.50–0.60 for the following year.

The FxPro Analyst Team