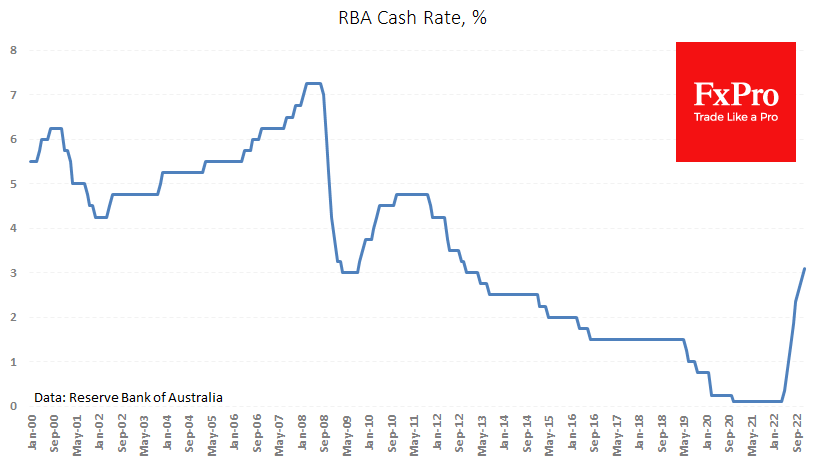

The Reserve Bank of Australia raised its key rate by 0.25 percentage points to 3.1% on Tuesday morning, meeting expectations. The current rate level is the highest in 10 years and the eighth consecutive hike, but the RBA has signalled more to come.

The RBA considers current inflation at 6.9% YoY “too high”, noting the contribution of global and local factors. The central bank is pointing at the need to balance supply and demand. Translated from central bankers’ language, it warns more pain for consumers to come via stricter credit conditions that are bad for jobs and loan rates. At the same time, Australia has moved from a run to a pitch for the third month, raising the rate by 25 points instead of 50.

While the Fed is also promising to slow down with tightening, the Reserve Bank of Australia did so earlier, widening the difference between the effective federal funds rate and the RBA key rate to 0.9 percentage points in November. This differential is likely to rise by 1.2 points after the Fed rate hike in just over a week by 0.5 points, as markets expect. Before March, the differential was -0.02 in favour of the AUD and later held in the range of 0.3-0.4 in favour of the USD.

The main intrigue of the forex market is the answer to whether we will see a recovery of the 2018-2020 regime when the key rate in the USA was more than a percentage point higher than the Australian one. Fundamentally, this resulted from the US and China trade wars, which slowed the latter’s growth. The technical manifestation for the forex market appeared to be pressure on the AUDUSD pair during this period, which was losing smoothly due to a sustained play on the interest rate differential – the carry trade.

Since October this year, when markets began to price in a slowdown in the pace of Fed rate hikes, the AUDUSD has shown a 10% rise, which has been losing strength in recent days in anticipation of new regulatory signals. As the differential continues to build, pressure on AUDUSD could once again become the primary short-term trend, following the November recharging of dollar bulls. On the side of the Aussie, bulls could be played by Australia’s tight labour market, with the lowest unemployment rate since 1974 and China’s recent reversal to a stimulus after quarters of slowing growth. If these factors remain in place, they will allow for a noticeably higher rate hike in Australia than in the USA, returning curry traders’ interest in buying AUDUSD.

The FxPro Analyst Team