AstraZeneca has reported a 10% rise in product sales for 2020, a year in which the drugmaker has featured prominently for its work developing a coronavirus vaccine, alongside the University of Oxford. The Anglo-Swedish pharmaceutical giant reported product sales totaling $25.8 billion for 2020. For the fourth quarter, sales rose 12% to just over $7 billion — the first time for “many years” the company has topped this figure. Total revenue came in at $26.6 billion for the year, and $7.4 billion for the fourth quarter.

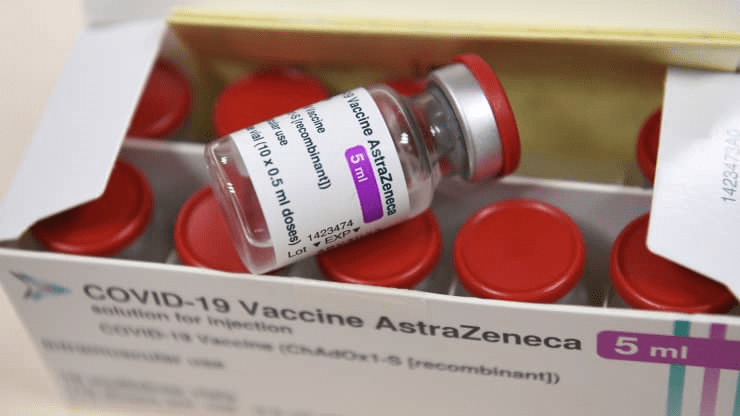

The company’s earnings come as the company remains in the spotlight for its coronavirus vaccine, which is being heavily relied upon by the U.K., EU and others as they try to bring an end to the public health crisis caused by the pandemic. AstraZeneca has said it will provide access to its vaccine at no profit for the “duration of the pandemic,” although the timing on this is uncertain. It has also committed to provide the vaccine on a not-for-profit basis in perpetuity to low- and middle-income countries. As such, its current earnings did not include sales of the vaccine.

Year-ahead guidance from the company, which is listed on the London Stock Exchange, stated that it expected revenue growth of a “low teens percentage” in 2021, and faster growth in core earnings per share to $4.75 to $5.00. The guidance does not incorporate any revenue or profit impact from sales of the Covid-19 vaccine, it said, and the company intends to report these sales separately from the next quarter. In the results report, AstraZeneca CEO Pascal Soriot said the performance last year “marked a significant step forward for AstraZeneca. Despite the significant impact from the pandemic, we delivered double-digit revenue growth.”

AstraZeneca sales rise 10% in 2020, sees revenue growth ahead, CNBC, Feb 11