After the best week in years for a number of Asian stock markets — following the worst month in years for many — the region’s equities traded on a down note Monday amid profit-taking after surges late last week. Japan’s Nikkei NIK, -1.55% closed down 1.5% after its best week since mid-2016, following Friday’s declines in the U.S. and amid persistent concerns about rising borrowing costs, U.S.-China trade conflicts and their effects on corporate results. Subaru 7270, -5.00% fell about 5% and Uniqlo parent Fast Retailing 9983, -4.76% was off 4.8%.

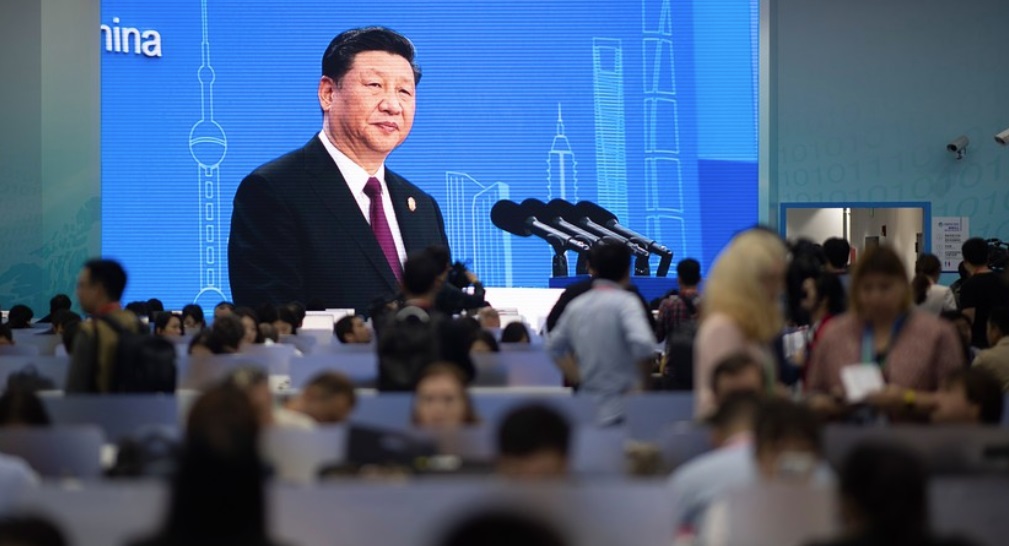

Chinese stocks were off even after President Xi Jinping praised globalization and China’s commitment to free trade as he kicked off a trade expo in Shanghai. The Shanghai Composite SHCOMP, -0.41% fell about 0.4% while the smaller-cap Shenzhen Composite 399106, -0.01% was flat. Hong Kong stocks were among the region’s biggest decliners. After ending last week with a 4.2% gain, the most in seven years, the Hang Seng Index HSI, -2.08% was down 2%. Trade worries persisted, as did concerns about the mainland economy, after a new report found China’s service-sector growth fell to a 13-month low in October. Tencent 0700, -3.69% was down 3.8% while automaker Geely 0175, -2.80% fell 3.7% and smartphone-component maker AAC 2018, -7.38% shed 7%.

Korea’s Kospi SEU, -0.91% shed 0.9% after its 3.5% surge Friday, its best day in seven years. Index heavyweight Samsung 005930, -0.79% was down almost 0.7%. Singapore’s benchmark STI, -1.83% posted a loss of around 1.8%. Busting a winning streak that lasted five sessions, Australia’s ASX 200 XJO, -0.53% closing down 0.5% and New Zealand’s NZX 50 NZ50GR, -0.64% eased 0.6%.