Asian stocks fell on Tuesday following a major speech by Chinese President Xi Jinping, tracking losses on Wall Street as traders braced for an interest rate hike by Federal Reserve. Japan’s Nikkei 225 index NIK, -1.82% was 1.6% lower and the Kospi SEU, -0.43% in South Korea dropped 0.4%. Hong Kong’s Hang Seng HSI, -1.05% slipped 0.9%. The Shanghai Composite index SHCOMP, -0.82% dropped 1%, as did Australia’s S&P ASX 200 XJO, -1.22% . Shares were lower in Taiwan Y9999, -0.70% and Southeast Asia.

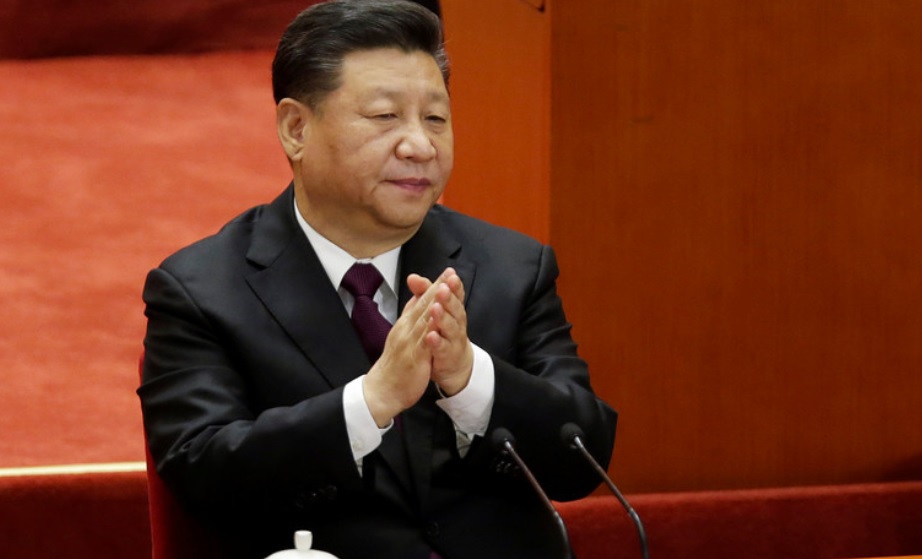

Investors had been anxiously awaiting a speech by Xi to commemorate the 40th anniversary of China‘s economic reforms. Some analysts were hoping Xi would announce new commitments to a free-market economy. Xi said economic reforms will continue, where needed. “We will resolutely reform what should and can be reformed, and make no change where there should and cannot be any reform,” he said.

He added that China has reached a point where it must move forward. “We will reinforce the development of the state economy while guiding the development of the non-state economy,” Xi said. “Opening brings progress while closure leads to backwardness.”

The Federal Open Market Committee begins a two-day meeting on Tuesday. It is expected to raise its short-term interest rate by a modest quarter-point, to a range of 2.25% to 2.5% a day later. Investors fear more monetary tightening would weigh on U.S. growth, and eventually, the global economy, that is already expected to slow in 2019 because of trade tensions. President Donald Trump tweeted that it was “incredible” the Fed was considering another rate hike, with “a very strong dollar and virtually no inflation.” The central bank forecasts three more rate hikes in 2019.