Asian markets mostly rose Wednesday as traders awaited a Federal Reserve policy meeting and U.S.-China talks, though Japan’s benchmark declined. All eyes are on a Federal Open Market Committee meeting ending Wednesday. Although the Fed is expected to leave its short-term interest rate unchanged, the nuances of a press conference by Chairman Jerome Powell will be closely watched.

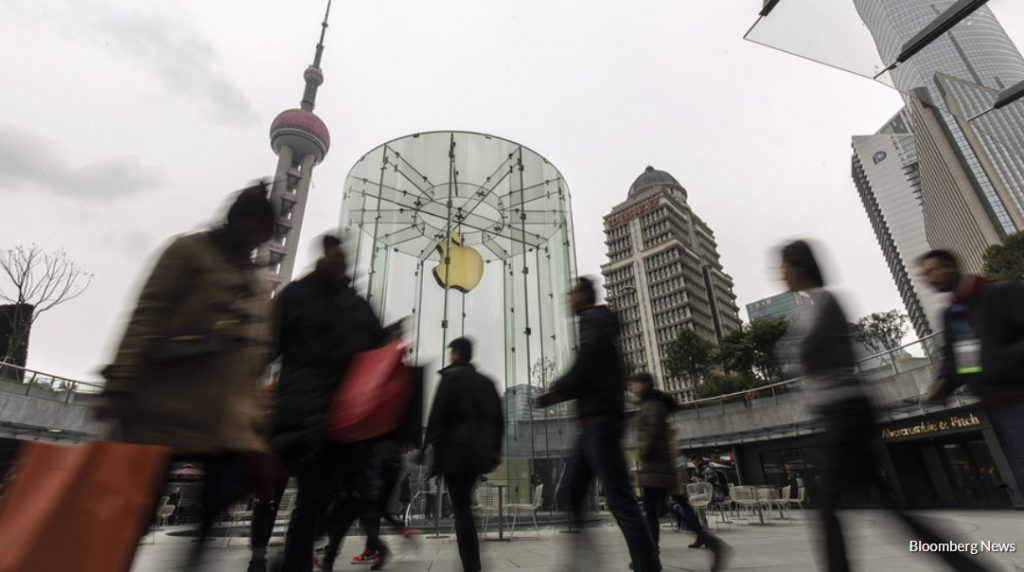

American and Chinese officials will begin two days of trade talks in Washington. President Donald Trump will reportedly meet Chinese Vice Premier Liu He in an attempt to move negotiations forward. But the Justice Department’s charges against Chinese tech giant Huawei, its subsidiaries and a top company executive may be a hurdle. China has urged U.S. authorities to end what it called an “unreasonable crackdown” against Huawei, which has been accused of stealing technology and violating sanctions on Iran.

“Asia’s markets are trading quietly sideways this morning, and we would expect that to be the theme of the day as the event-risk needle swings much higher from tonight in North America,” Jeffrey Halley of Oanda said in a market commentary. Benchmark U.S. crude CLH9, -0.30% rose 15 cents to $53.46 per barrel in electronic trading on the New York Mercantile Exchange. It gained $1.32 to settle at $53.31 per barrel on Tuesday. Brent crude LCOH9, -0.29% , used to price international oils, picked up 21 cents to $61.41 per barrel. The contract added $1.39 to $61.20 per barrel in London.

Asian markets mostly higher ahead of Fed meeting, latest trade talks, MarketWatch, Jan 30