The Co-Founder and CEO of Bitmex, Arthur Hayes, has made a bold prediction that the price of Yearn Finance (YFI) will eventually hit $100,000. Mr. Hayes made this prediction not once, but on two occasions in the last 24 hours. The first time was when Yearn Finance broke $27,000 with the second being when YFI crossed $32,000. Mr. Hayes made the prediction via the following two tweets.

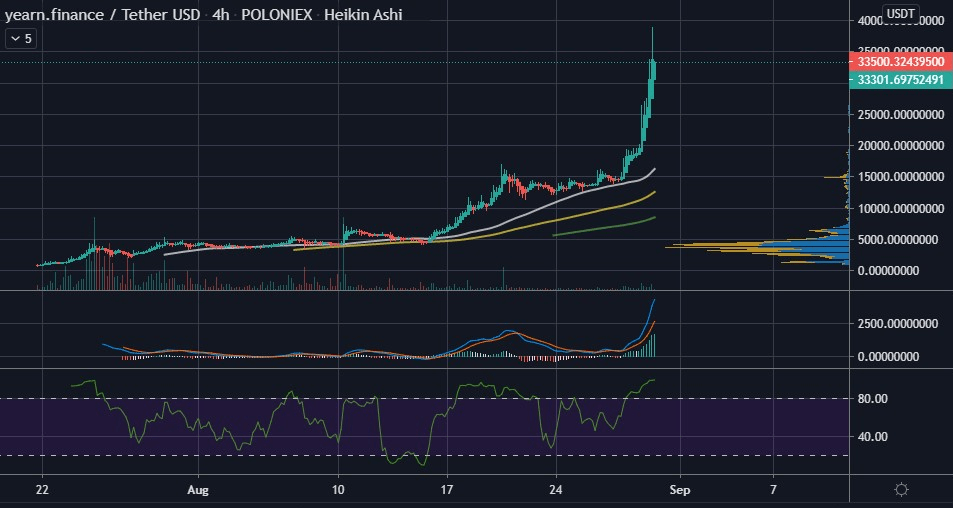

Yearn Finance (YFI) has taken ChainLink’s place in the crypto-verse in the sense that finding a local top has become a guessing game. For the better part of August, LINK’s price kept traders and investors on their feet wondering if it was time to take profits or start shorting the digital asset. To get a feel of what the future holds for Yearn Finance (YFI), the 4-hour YFI/USDT chart will be used.

Poloniex seems to be the only crypto-exchange with a long enough price history of Yearn Finance (YFI)

YFI’s data on Poloniex goes back to as far as 21st July providing the first warning sign that YFI is very new

When listed, YFI opened trading at $931 on Poloniex

YFI’s value currently stands at $33,100 signifying a 3,455% increment in value in roughly a month

4-hour MACD is overextended pointing towards the possibility of a pullback or sideways

The 4-hour MFI is high at 100.52 further hinting towards a pullback

Yearn Finance’s price is above all the moving averages: 50 MA, 100 MA and 200 MA

Short term support zones can be found at previous all-time highs: $27,000, $23,400, $19,400

Yearn Finance (YFI) has once again posted an all-time high value of $39,000 – Poloniex rate. This is after it posted two previous peak values of $27,154 and $32,843 within the same 24-hour time period. The impressive momentum of Yearn Finance has resulted in the Co-Founder and CEO of Bitmex, Arthur Hayes, predicting that YFI can go as high as $100,000.

Arthur Hayes: 1 Yearn Finance (YFI) = $100,000, EthereumWorldNews, Aug 31