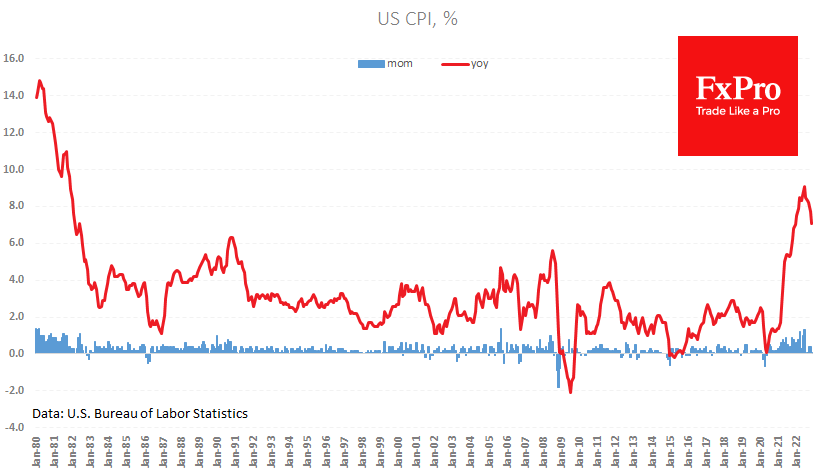

US consumer prices added 0.1% for November, significantly weaker than the expected 0.3%. The annual price growth rate slowed to 7.1% YoY against expectations of 7.3%, 7.7% a month earlier and two percentage points below the June peak.

An important factor was the release of a lower-than-expected Core-CPI, which decreased to 6.0% YoY. This strongly indicates that the fall in commodity prices is also spreading rapidly across the basket.

For market players, such data reinforces expectations that inflation has proved more responsive to rate hikes and less sticky than warned at the Fed and feared by markets in previous months. The weak inflation strengthens hopes that Powell’s tone tomorrow will be more amicable than in the last few months.

In terms of interest rates, this means that after three 75-point hikes, the main scenario is another 50-point increase, followed by two 25-point hikes.

If the inflation rate continues to react “favourably” to high-interest rates, the central bank’s QE policy could already end at the end of 2023.

However, such expectations are very fragile constructions. Producer prices rise did not slow in November, adding 0.3% m/m for the 3rd month in a row. The annual growth rate is falling due to a high base effect but not due to a fall in prices. At the same time, the labour market remains “tight”, suggesting further pressure on prices due to wages. Thus, it may be too premature to celebrate victory over inflation and bet on an end to policy tightening by the Fed or other central banks.

The FxPro Analyst Team