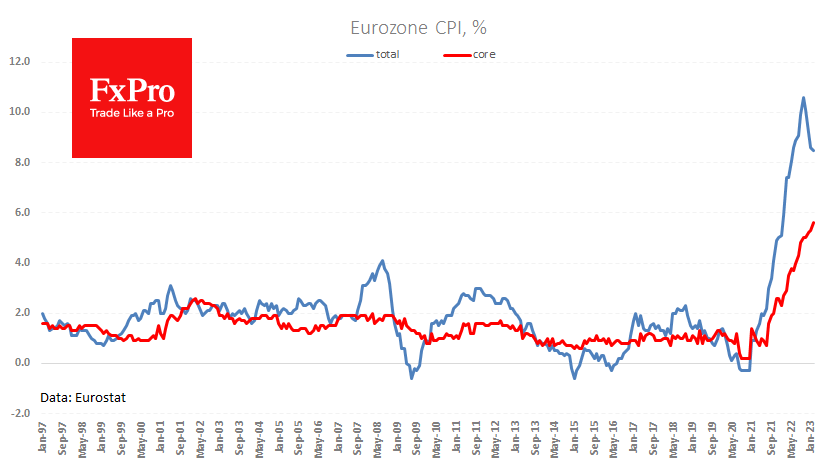

Although commodity and energy prices have retreated from their highs and supply chains have recovered over the past year, inflation remains a problem. This thesis was confirmed today for the eurozone. Eurostat estimated overall price growth in the Euro region at 8.5% y/y. This is a step down from 8.6% a month earlier and a peak of 10.6% in October, but economists, on average, expected to see a slowdown to 8.3%.

Even more attention should be paid to the continued growth of core CPI, from which energy and food are excluded. Its annual growth rate accelerated to 5.6% against expectations of a 5.3% deceleration. This acceleration represents a much bigger problem than the jump in energy prices. For the last 17 months, it has been above the 2% target. At the same time, the Euro-region’s unemployment rate of 6.7% is very low. This combination dramatically increases the risks of stalling inflation expectations.

The only way for the central bank to tackle them is to rein in the economy by pushing it towards contraction to reduce the domestic pressure on prices. If the ECB is serious about fighting inflation, it must act sharper and longer in raising rates and quantitative tightening. That sounds like good news for the euro, but traders should be aware that markets are quite prepared for the current publication from earlier in the week when individual country data was released. In addition, the historically positive correlation between EURUSD and stock indices should be noticed: declines in equity indices are weighing on the pair today.

The FxPro Analyst Team