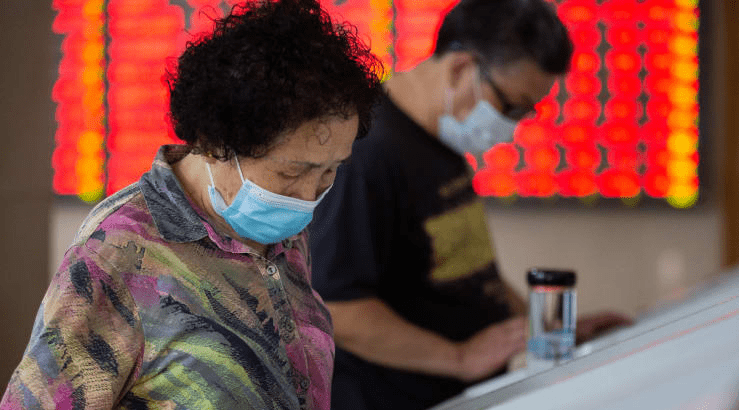

China’s recent stock market rally is raising fears that it’s being driven by retail investors indulging in leverage-fueled risky trading which caused a spectacular crash back in 2015. Analysts say they are monitoring levels of margin trading, or the practice of borrowing money from brokerages to trade.

That comes as mainland Chinese markets surged in early July. In the first two weeks of this month, the Shanghai composite rocketed 14%. The CSI 300 index jumped more than 20%, and the Shenzhen composite soared 17%. That rally drove the China Securities Regulatory Commission to issue a warning to investors to stay away from lenders that are illegally providing financing for margin trading. Margin trading comes with risks as investors are using borrowed money, and therefore any losses in the investments will be magnified as traders would need to pay back the interest as well.

According to data from China Securities Financial Corporation, which refinances margin trading and has liquidity support from China’s central bank, margin financing loans in June were 33% higher than in May. In the first week of July, the margin balance outstanding in China accelerated 9% to 1.3 trillion yuan, according to a South China Morning Post report.

Some platforms illegally financing margin trading were allowing investors to borrow over 1,000 yuan ($143) to buy stocks for a deposit of as little as 100 yuan, a leverage of 10 times, according to Chinese media Caixin Global.

In 2015, there was a similar boom and bust in China fueled by illegal margin lending that saw the Shanghai composite fall more than 40% from its peak in just a few weeks, according to Reuters. More than $5 trillion was wiped off the capitalization of the Shanghai and Shenzhen markets after they peaked in June in that year.

Chinese state media earlier this month also warned investors to respect the market and manage risks.

Analysts warn of ‘double edged sword’ in China market rally as investors indulge in frenzied, risky trading, CNBC, Jul 22