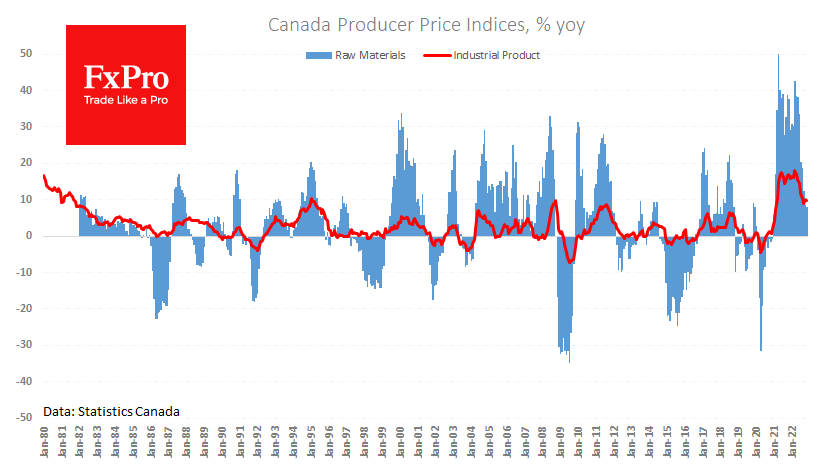

Canada’s producer price index fell 0.4% in November, sharply contrasting with the expected 2.2% m/m increase after jumping 2.4% m/m. An even more shocking contrast was in the commodity price index, where the decline was 0.8% m/m instead of the forecast 3.2% m/m increase.

The annual growth rate for commodity prices fell to 8% after peaking at 42.6% in March. The producer price index added 9.7%, almost twice as slowly as in March.

Substantially weaker inflation data is a cause for speculative selling. But this momentum was not sustained on Monday, as the USDCAD sold off on the approach to the 1.3700 area, where the pair has been turning down since early December.

Over the past six weeks, USDCAD has rallied as the Bank of Canada, like the Fed, signalled a slowdown in rate hikes. Weak inflation data will allow Canada to reach the terminal rate level even earlier. On the other hand, slowing inflation enables the currency to retain its purchasing power.

The FxPro Analyst Team