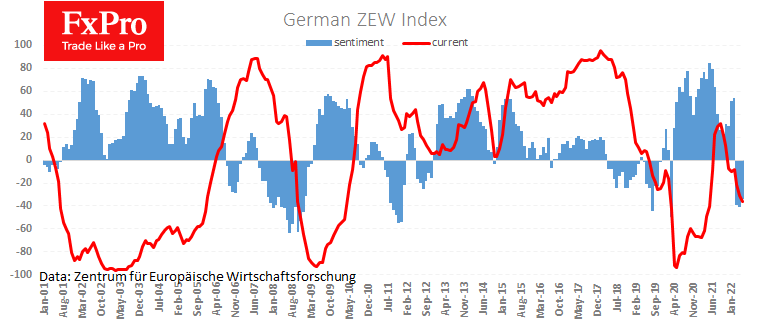

Economic Sentiment in Germany rose unexpectedly, according to the latest May assessment. The corresponding ZEW indicator rose to -34.3 in May from -41.0 a month earlier, against expectations of a dip to -43.0.

Meanwhile, the current assessment of the economic situation continues to deteriorate, both under the influence of the situation in Ukraine and due to a slowdown in China. Germany, for which China is the main export market, is concerned with the lockdown in the second world economy and the resulting economic slowdown and falling demand for machinery and cars from Germany.

Despite the lapse in the current assessment, investors and traders are paying more attention to sentiment. The positive surprise helps EURUSD stabilise near 1.0500 and reinforces the bulls’ hopes that a straight road below parity is not yet a done deal.

The FxPro Analyst Team