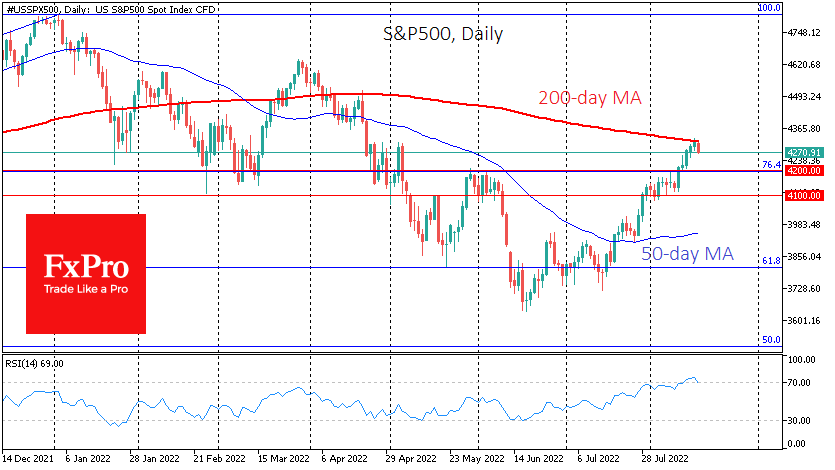

The S&P500 index has gained 4.2% in the previous five trading sessions, ending Tuesday’s trading above the 4300 mark. However, two ingredients are missing for the bulls to win. Firstly, consolidation above the 200 SMA is an essential technical indicator of a return to the bull market. Secondly, the Fed’s tone has changed to a more amicable one, which investors and traders will look for in today’s FOMC minutes.

Some observers note that the market rally is going on a broad front, as 90% of names in the S&P500 are trading above 50-day moving averages (DMA). This is a crucial bullish signal, indicating a break in the short-term downtrend. Statistics over the past 20 years suggest that after such a sign, stocks gain averaged 1.2% over the next month and 16.75% over the next 12 months. The latter figure is almost double the historical average, indicating a buying opportunity.

However, traders should be wary that the market has accumulated the local overbought and may meet correction just around the corner.

The S&P500 index futures are losing about 0.9% since early Wednesday, showing a neat reversal from the 200 DMA. From the same line, we saw a sharp strengthening of selling twice in April.

The stock market reached its current highs in the form of the circular 4300 level, having entered the overbought area of the RSI. The last time this index was above 70 was in November, the final stage of the previous bull market. In April last year, we saw a corrective pullback at similar heights in the index. The latter looks like the most likely scenario right now.

In addition, the news background is quite suitable for this scenario. Weaker than expected US retail sales figures have just been released. Next on the agenda are the Fed minutes, where market participants may well discern more hawkish signals than they have been tuning in to in recent days.

After all, participants’ sentiment was shaped by data on slowing inflation, which was not available to the FOMC at the time of the meeting. If the bulls win and S&P500 can close above its 200-day average today, we could state that investors are now ready to go ahead despite the accumulated technical exhaustion. And it is also understandable, given the significant correction in the year’s first half.

The FxPro Analyst Team