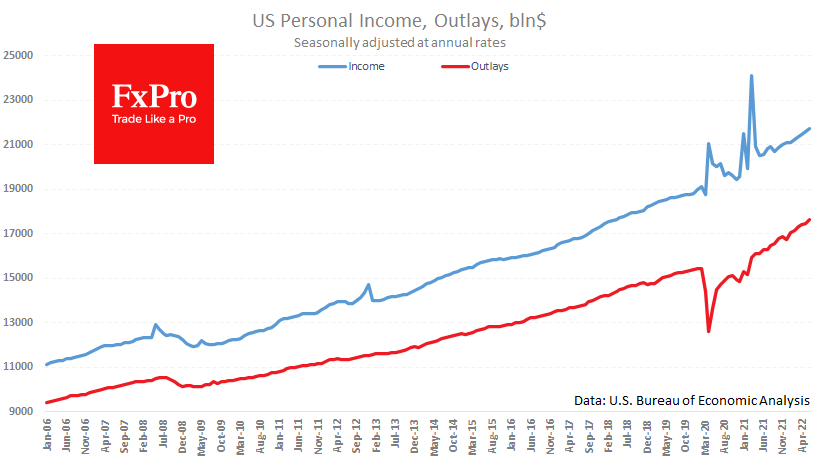

Americans increased spending (+1.1%) faster than income (+0.6%) in June. Both figures exceeded expectations, which is a bullish signal for the markets and the dollar as it shows buying is in good shape.

But this may only be a good façade, which hides the difficulties. Last month Americans put away $944bn (on an annualised basis), which is the lowest in nominal terms since December 2016. The savings-to-income ratio fell to 5.1%, the weakest since August 2009.

The ratio was sustainably below 5% during the final stages of the economic boom: in 2000-2001 and 2005-2008. Both episodes were harbingers of disaster for the stock market and took place during periods of rapid monetary policy tightening by the Fed.

The fundamental reason for the weakness in equities during this period is the relatively high market valuation (P/E), as is the case now. Consumers cannot increase spending further, which harms corporate profits and forecasts and ends in staff cuts.

Comments from the Fed or the Treasury, led by past Fed chief Yellen, make us look at the current picture, which is quickly becoming obsolete. Further, the economy may have no engine left for growth in the form of consumer spending while the housing market is already throttling.

The FxPro Analyst Team