Oil was bought during the downturns on Thursday and Friday, with most buying activity during the US trading session. On Thursday and Friday, buying in US trading took the price out of the initial drawdown, closing the day near intraday highs.

Interestingly, this did not trigger stop orders during Asian trading, indicating an impressive supply in Asia and Europe.

There is news that Saudi Arabia has raised selling prices for Asia next month. Typically, this news causes a steady rise in quotations, but this time the opening spurt failed to hold, and at the time of writing, WTI and Brent are losing around 1.6% since the start of the day.

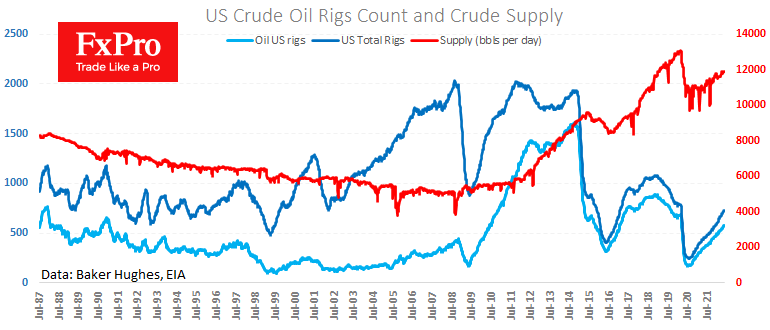

Weekly inventory and production data indicate that the US is in no hurry to ramp up production. Friday’s data from Baker Hughes noted the number of drilling rigs operating at 574, the same as a week earlier and two lower than three weeks ago: an apparent stagnation, contrary to high prices, the looming road trip season and high prices.

Even earlier last week, the official EIA report noted the third week of declining commercial inventories with the continued sell-off in oil reserves, which are already at their lowest level since 1987. The USA is not yet in a hurry to increase production, which further fuels the local price increase.

Today Biden is expected to unveil a new support package for alternative energy. The continued focus on clean energy in the world’s largest economy will deter oil producers from investing heavily in conventional production.

The higher rate of OPEC+ quota increases suggests that the cartel considers current levels attractive for raising its share. In this environment, it will not be surprising if we see more inclination to increase production from conventional oil producers in the coming weeks.

The FxPro Analyst Team