Indices in the US and Europe declined due to the heavy selling of stocks triggered by investors exiting AI-related companies in the US. The reason for the relatively sudden sell-off was the rumoured high quality of AI model results from China’s DeepSeek-R1, unveiled on Monday. It is free for users, training was significantly cheaper than its US counterparts, and the results sometimes outperform ChatGPT.

In this environment, investors have started to exit the most popular trades of the past two years. Nvidia shares lost over 10% in the premarket, sending the Nasdaq-100 index down more than 5% from Friday’s closing level.

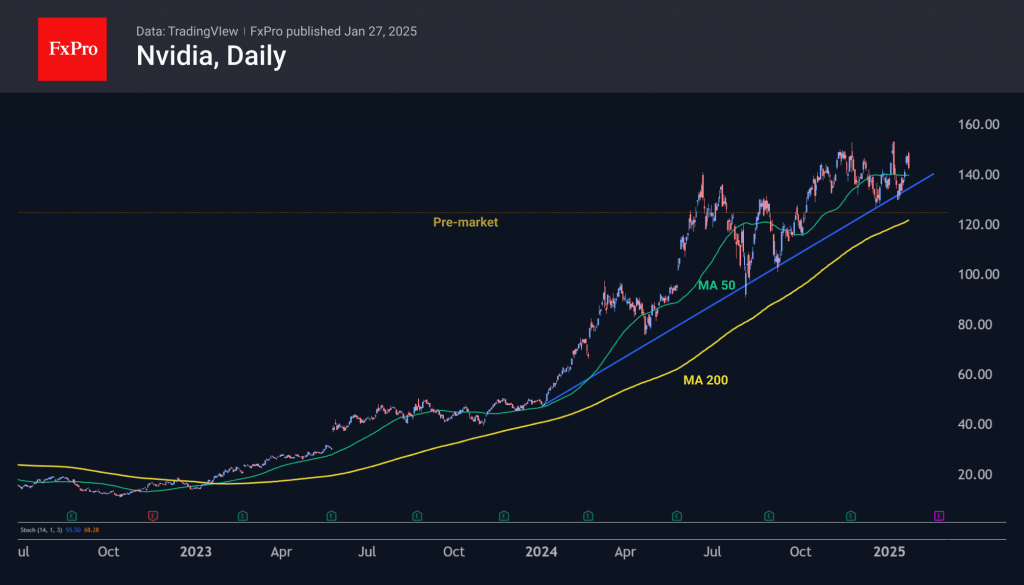

Markets are sensitive to this situation, as heightened price competition raises doubts about the timing of when profits from multi-billion-dollar investments will materialise. This is also putting pressure on Nvidia. Currently, it’s down 11% to levels below $127, testing the lower end of its trading range from October.

Technically, the latest decline breaks the upward trend of the entire 2024. The price is now approaching its 200-day moving average, above which it has traded solidly since early 2023. The situation looks like profit taking from the AI rally of the last two years, which is putting pressure on the market.

Nasdaq-100 index futures are trading below the 21000 level, back to the highs of last July. The fact that the market has reached these levels again after two weeks without updating the historical highs indicates increased seller activity. Under such conditions, the probability of the index dropping to a lower level is increasing.

The nearest target for sellers is the area of 20000. This is a significant level near which the 200-day moving average passes. Approaching this level attracted buyers in August and September last year, as well as in October 2023.

A fall below this level early in the week could trigger a further decline in share price, which could reduce market capitalisation by another 5-10%.

The FxPro Analyst Team