Ahead of Friday’s employment report, we turn our attention to other labour market releases.

ADP’s estimates for March showed private sector employment rising by 184K, the highest since July 2023 and above the expected 150K. In a commentary on the release, ADP’s chief economist notes not only the general increase in wage pressures (in contrast to cooling inflation) but also the set of sectors that saw the biggest gains: construction, financial services, and manufacturing.

The release notes a 5.1% y/y increase in wages for job-stayers and a 10% surge for job-changers.

Judging by this report, the most anticipated recession in US history is once again being pushed ahead. For traders, this means that the chances of an easing of US monetary policy are further diminished as wage growth is well above the inflation target and gaining momentum.

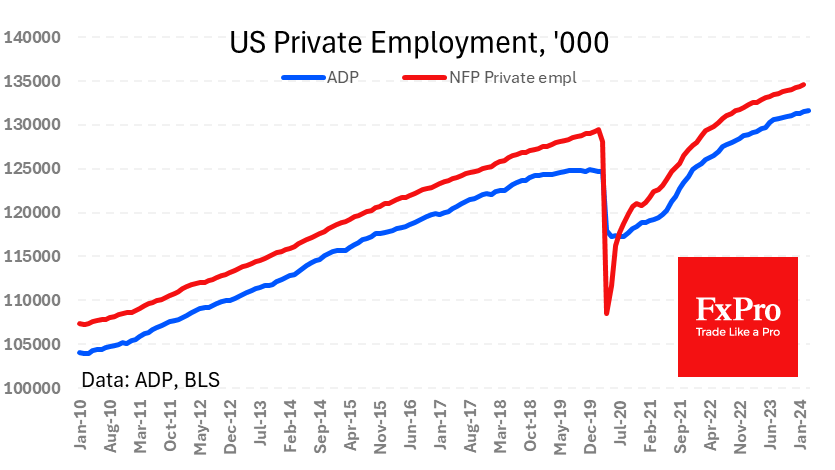

However, it is worth noting that ADP figures have diverged from official statistics in recent months, leaving the NFP as the king of unpredictable key market indicators.

The FxPro Analyst Team