ADP estimates of the US labour market two days before the official release painted a relatively bleak picture. The private sector reportedly created 113K new jobs in October after 89K a month earlier. Analysts, on average, had forecast growth of around 150K, so the current data did not meet these expectations.

In terms of company size, the largest contribution was made by medium-sized businesses with 50-249 employees (+96K) and small businesses with 1-19 employees (+21K). Companies of this size employ the largest number of Americans. Larger companies (250-499 employees) laid off 18K, but 500+ employers’ companies hired the same number of people.

By company type, the largest increases were in education and health care (+45K) and transport services and trade (+35K). Meanwhile, mining lost 1K jobs, and professional and business services lost 10K.

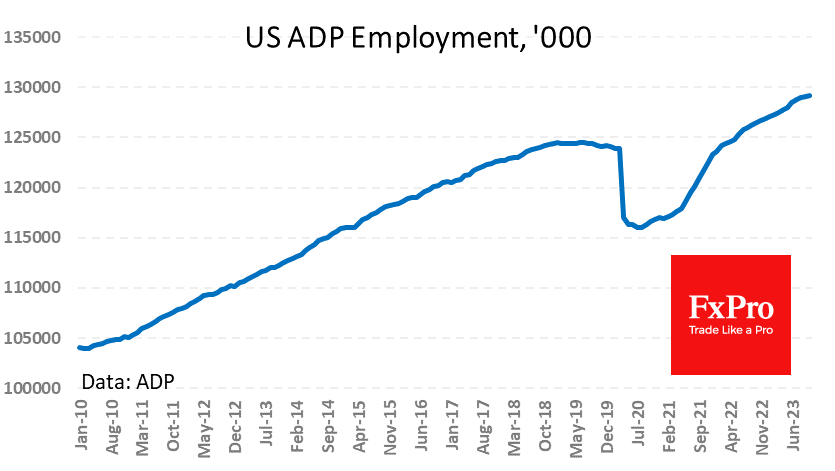

Two months of weak job growth against a backdrop of high interest rates set the stage for a possible repeat of the long labour market stagnation we saw from late 2018 to March 2020. However, confidence in the ADP statistics has sagged in recent months, as it differs markedly from the official data. The official BLS report in September noted a 263K increase in private employment – a 9-month high. The ADP noted the creation of 89K – the 32-month low.

The FxPro Analyst Team