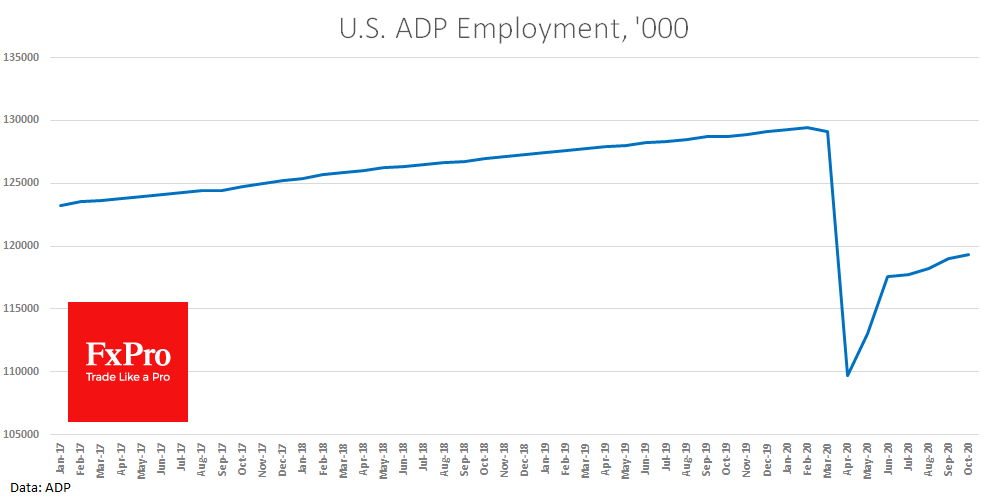

Both candidates, Trump and Biden, retain their chances for a win, but the macro data take its turn. Recent ADP statistics have disappointed the weak growth in private sector employment. The report says that the private sector added 365K new jobs in October, compared to 753K a month earlier and expectations of 650K.

The recovery in the labour market has clearly slowed down. The V-shaped rebound in the first two months was followed by increasingly slower recovery. Its current rate of growth is only twice as high as the average monthly growth of the last five years (180K).

This data could be an alarming sign to the Fed that the economy needs more help.

It seems that the US central bank will have to convince market participants tomorrow that the situation (at least in the financial markets) will not get out of control. If so, it will be good news for the markets, and bad news for the dollar as the Fed can print money, not the jobs.

The FxPro Analyst Team