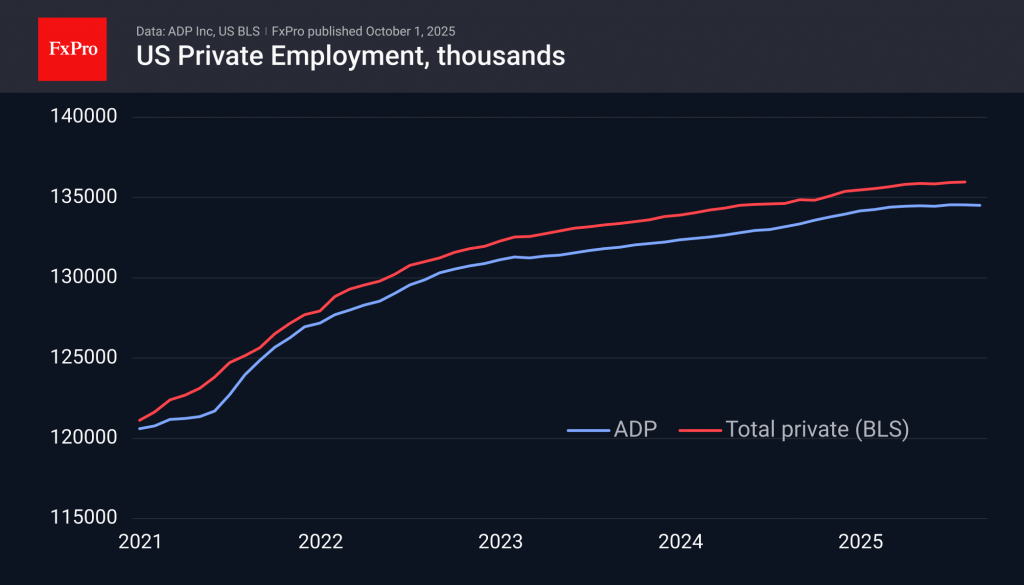

Independent data provider ADP reported a decline of 32k jobs in the US private sector in September. The data was significantly worse than the expected growth of 50k. Moreover, August figures were revised down from +54k to -3k. ADP thus paints a very bleak labour market picture, while recent revisions to official figures suggested that June was the worst point since the beginning of the year, followed by slight growth.

ADP data has lost much of its influence on the markets in recent years, proving to be a weak predictor of Friday’s official release, as originally intended. But this time, there is a risk that the official release will not be published on Friday at all due to the US government shutdown. The funding freeze has a significant impact on statistical services, which are considered less of a priority than courts, the military, and doctors.

Weak labour market indicators increase the chances of a consistent reduction in the Fed’s key rate. The probability of two more cuts before the end of the year rose to 91% on Wednesday after the ADP release, compared to 77% the day before and 40% a month ago.

Policy easing is bad news for the dollar, as long as we see a moderate decline. It would take a sharp decline in employment to trigger a wave of carry trade unwinding, which leads to impulsive sell-offs in stocks and commodities, attracting capital to short-term government bonds, which is good for the USD. However, until that point is reached, the prevailing pattern for equities remains “bad news is good news.”

The FxPro Analyst Team