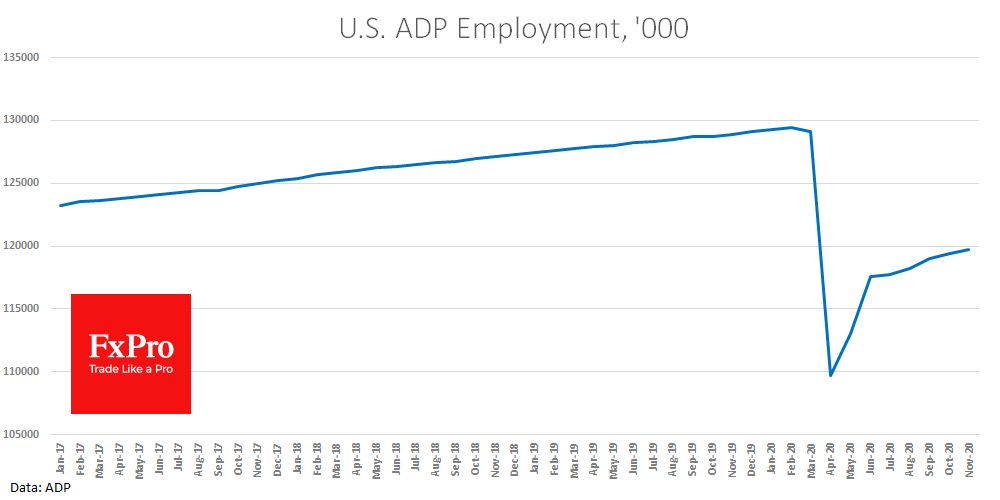

New employment data from the ADP for November has spurred fears that the labour market is losing momentum. The private sector added 307K new jobs, which is noticeably weaker than the 433K expected and 404K a month earlier.

So instead of the anticipated acceleration of the labour market recovery, we are witnessing further decay in this area – a worrying signal ahead of Friday’s labour market report.

Recently we received similar evidence of a weaker recovery that dragged the dollar lower. EURUSD returned to growth a little earlier in the day and received a new growth impulse after the ADP report.

Five Fed members’ speeches later today, as well as the publication of the Beige Book, could potentially reverse the sentiment on the dollar. However, the example of yesterday’s Powell speech in Congress makes us somewhat cautious about the immediate future of the USD.

The FxPro Analyst Team