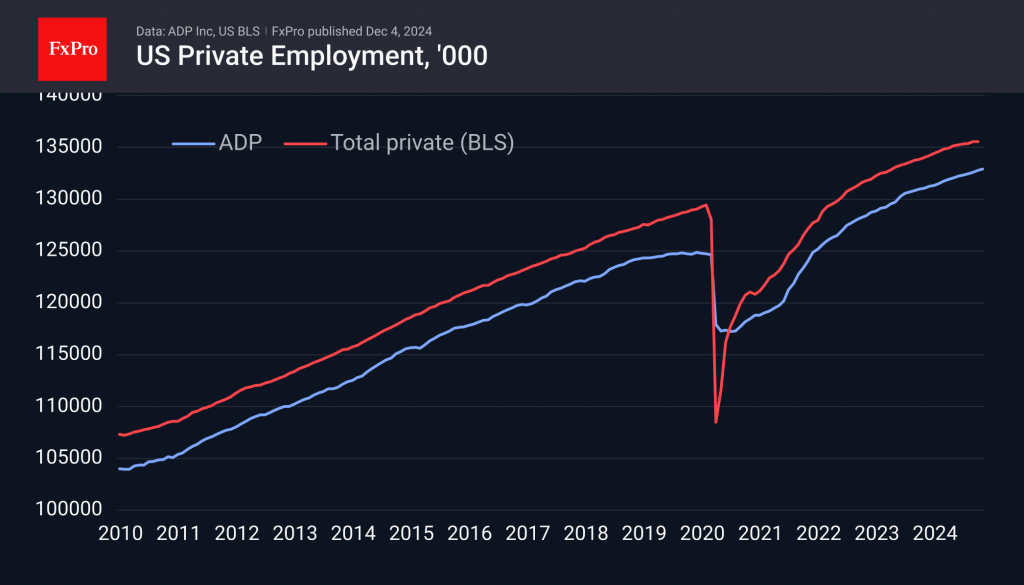

The most important publication in the coming weeks will be Friday’s US employment report. Ahead of that, we are turning our attention to other labour market indicators. Wednesday’s ADP private sector employment report is the closest we have to a data release, although it has given many false signals in recent months.

The data released was slightly weaker than forecast, with an increase of 146K versus the expected 152K. This level of forecast accuracy is quite rare for such statistics. These figures reflect a relatively healthy development in employment but should be taken with a degree of caution. A month earlier, employment growth was reported at 233K, but today, these figures were revised down to 184K. The official Bureau of Labor Statistics showed a decline of 28K in November. The huge discrepancy and the impressive revision downgrade in today’s release still form a positive backdrop, as the cumulative totals for the last three months (+163K/month) show an acceleration from the previous three months.

The only cause for concern is the 26K drop in industrial employment, which was the only sector to show negative momentum last month. This is in line with a similar trend in the official BLS data in recent months.

Among other data, we also look at the job vacancy rate, where the latest October data was the highest in three months. An even more important indicator was the manufacturing ISM, which rose from 46.5 to 48.4, indicating a less severe contraction than before.

All these data support the view that the US economy remains on a growth path. They allay fears of a new wave of inflation, allowing the Fed to cut rates further without fear of overheating the market. At the same time, this is a fairly strong set of data, leaving the potential for further buying in the equity market. Of course, this all assumes that the new incoming data (Trump administration initiatives and the employment and inflation report) remain within current expectations.

The FxPro Analyst Team