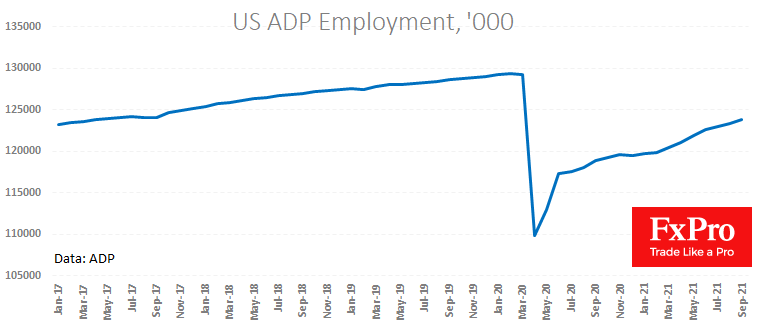

US private sector employment rose by 568K from August to September, the ADP said in a report two days before the official NFP publication. These estimates were well above the expected 425K, indicating an acceleration in employment growth after two months of weak data.

Strong labour market data is good for the dollar as it will allow the Fed to normalise monetary policy, dismissing fears that the economy has lost its recovery momentum. At the same time, it is mixed news for the stock market, as it supports higher yields in debt markets in the short term, which is negative for equities, although it keeps them attractive in the longer term due to strong economic growth.

Short-term traders should pay attention to the Dollar Index’s performance at 94.5. A move higher on the day would lock the index at a high for the year, confirming a bullish trend towards 100.

The FxPro Analyst Team