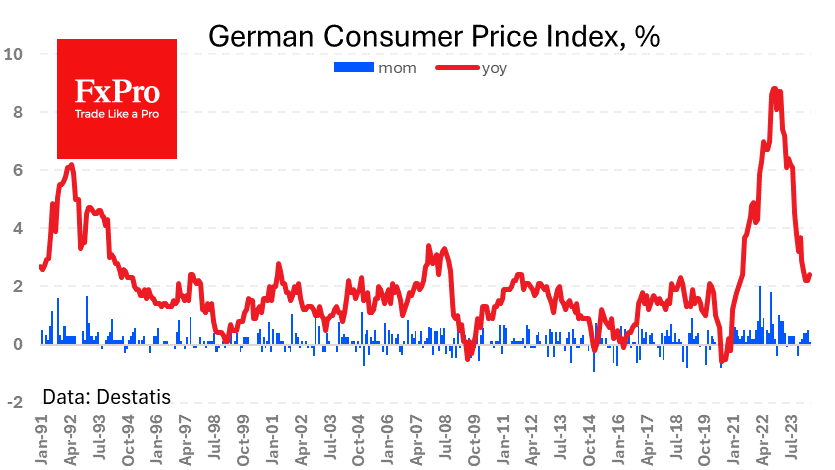

German inflation confirmed an acceleration. Harmonised CPI rose to 2.8% vs 2.4% a month earlier and 2.3% in March. This is positive news for the Euro, which is lagging behind the Pound and relatively weak against the Dollar, based on expectations of a looser ECB monetary policy against rivals.

A fresh batch of data from Germany casts little doubt on the ECB members’ widely announced policy easing on 6 June. Nevertheless, the acceleration in price growth, if sustained going forward, reduces the chances of the back-to-back cuts.

A sustained acceleration in inflation could revive interest in the euro, which earlier on Wednesday fell to its lowest in nearly two years. EURUSD has been hovering around 1.0850 for the past two weeks and could accelerate gains after a pause.

Potential weakness for the euro could come from the economic front, where an economic slowdown and sluggish lending, adding 0.2% to last year, the lowest since 2015, are increasingly evident.

The FxPro Analyst Team