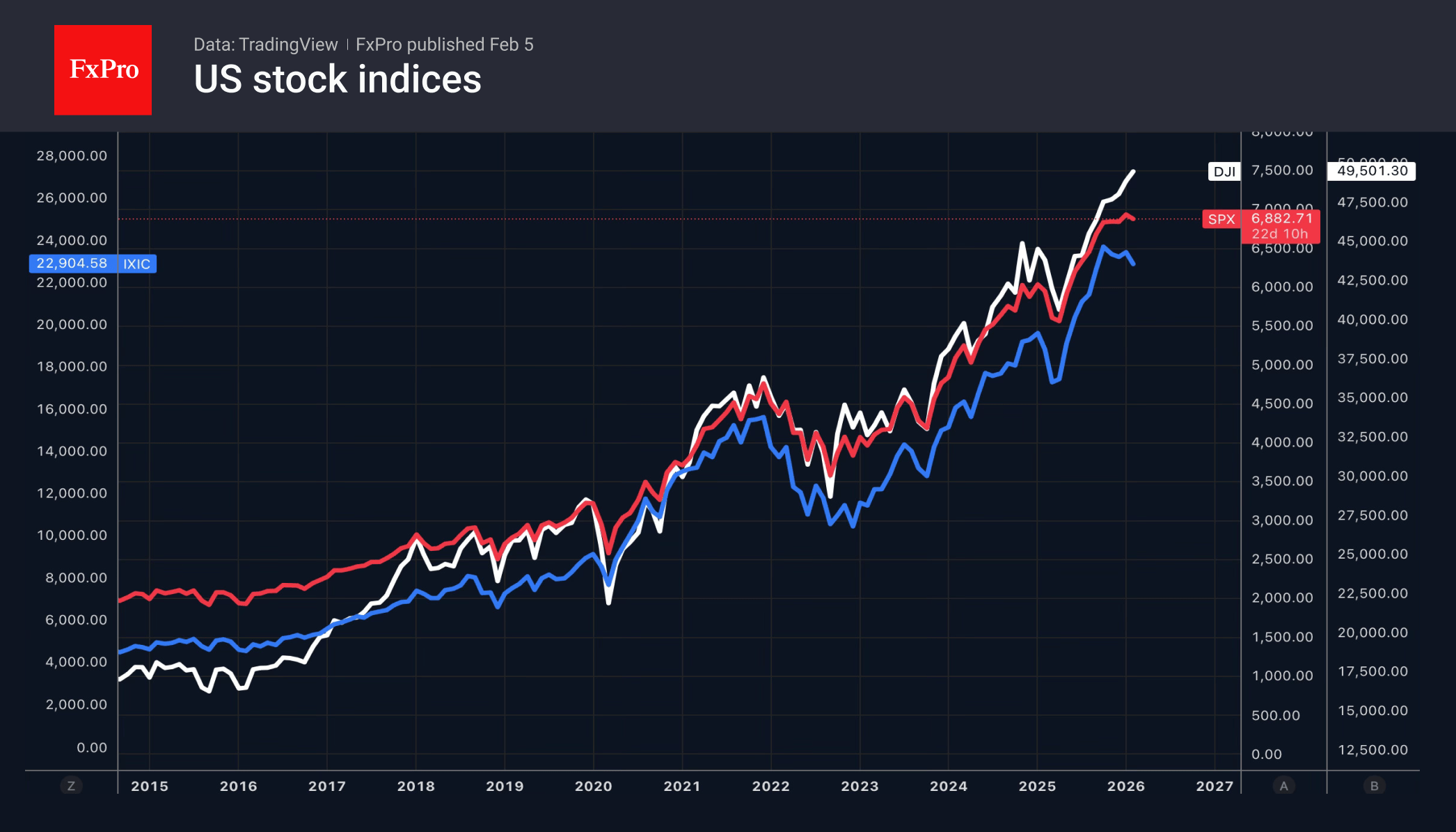

The launch of new products by the AI company Anthropic accelerated the rotation in the US stocks. While the Nasdaq Index recorded its worst two-day decline since last April, the S&P500 suffered less, while Dow Jones even tried to update its all-time highs.

Software companies’ shares fell victim to investors’ hot hands. There are fears that the development of artificial intelligence technologies will deal a blow to their business. Traders are speculating about which companies AI will drive out of the market next. Tech giants, including Meta and NVIDIA, have also been hit, with investors selling their shares to offset losses from software manufacturers.

In contrast, demand for stocks sensitive to the state of the economy is growing. On the 4th of February, the shares of 92 companies from the S&P500 reached record highs. This is the highest figure since November 2024. Of these, 27 are related to manufacturing, 15 to finance and 10 to the energy sector.

The FxPro Analyst Team