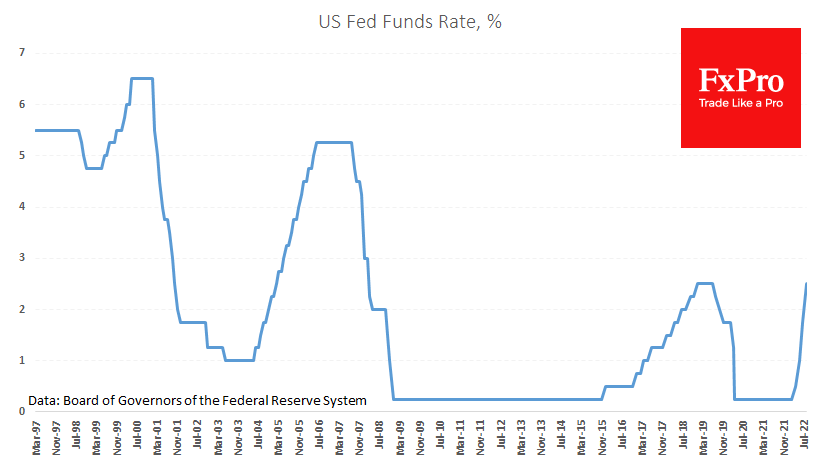

The Fed raised the rate by 75 points as expected by most, but this caused a relief rally in risk-sensitive assets. Powell also expressed his willingness to increase the rate further. Nor did he rule out further abnormal steps if the data demanded it.

Looking at the market reaction, one would think that the rate was cut, or at least promised not to raise it soon: S&P500 is up more than 2.2%, crypto market capitalization is up almost 9%, silver added 4.5%, gold 1.5%.

The market tried to play the “buy rumours, sell facts” game. On top of that, there was a more than 25% chance of an immediate 100-point rise. The market balancing act gave the impression that yesterday’s Fed move brought positive. But several signs make it doubtful that the latest rally lasts.

On Thursday, dollar buyers returned to the currency market, but the decline in the USDJPY to lows has been even more remarkable since the start of July. This indicates that big capital is not too keen to celebrate the interest rate hike and is carefully selling risky assets.

It’s also worth remembering that the Fed is holding the most aggressive rate hike in 40 years, tightening financing conditions. Already this has resulted in a housing market disaster, with sales volumes dropping by around 20% from last year’s levels.

The US economy has had a more challenging time with slower rate increases since the global financial crisis. The latest, most drastic tightening has occurred in recent months, and the transmission period between rate changes and the effects on the economy takes half a year at the earliest.

So the new figures of a second consecutive quarter of GDP contraction in the USA are only the first echoes of the impact on the economy in the coming months. Accordingly, consumers and companies will also feel worse, affecting global risk appetite.

The FxPro AnalystTeam