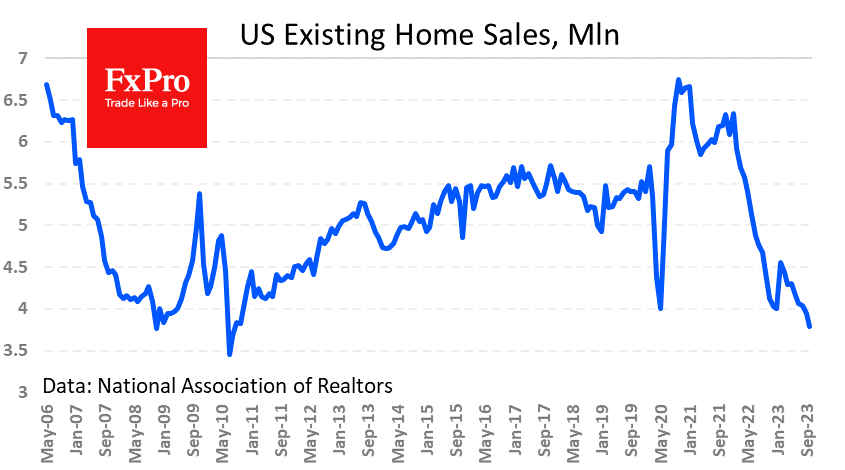

US Existing Home Sales have continued to fall under the pressure of high interest rates despite prices retreating from their highs.

It is well known that the housing market is a leading indicator of the economic cycle. This was the case during the global financial crisis. However, this approach may need to be revised this time around.

In October, secondary market sales fell by 4.1% to 3.79 million at an annualised rate. Sales have fallen in seven of the last eight months. That’s only 9% below the market’s low in July 2010. But in that period, the unemployment rate was near 9.5% (near the cyclical peak), as opposed to the current 3.9% (near the cyclical trough).

Inventories of unsold homes are at 3.6 months at the current pace. While this is the highest level since June 2020, it is more attributable to lower sales, as nominal inventories are at a one-year high of 1.15 million homes, which is not a meaningful increase.

The median home sale price fell 4.4 per cent to $391.8k, down from a peak of $410k in July.

It’s a very different picture in the new home market, where median prices are falling faster, down 15.7% from their peak. At the same time, the number of homes sold has been rising for more than a year. This means that people are moving into newer, arguably simpler housing.

For the financial market, the dip in secondary market sales isn’t as bad a sign as the headlines might suggest but instead reflects a temporary change in buyer preferences. A further fall in secondary market prices could be a wake-up call, where a further 10% fall from current levels could trigger a wave of mortgage defaults and cause problems for the banks, as was the case in 2007-2008.

The FxPro Analyst Team