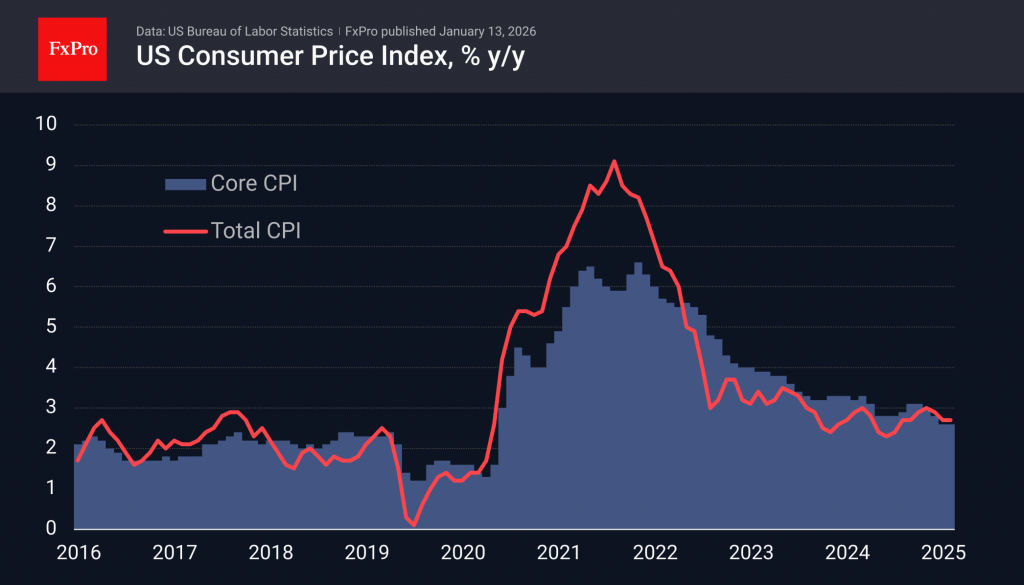

The US consumer price index rose 0.3% in December, maintaining an annual growth rate of 2.7%, which is in line with analysts’ average forecasts. At the same time, core inflation, which excludes food and energy prices, remained at 2.6% year-on-year, against an expected acceleration to 2.7%.

Initially, this data sparked a surge in risk appetite, pushing the S&P 500 towards 7,000 on the back of softer-than-expected data. However, this did not significantly affect the assessment of the Fed’s key rate change in the coming months, returning stock indices and the dollar against major currencies to their previous levels.

Failure to test historical highs in the S&P 500 and serious resistance at 1.3500 in GBPUSD could trigger a wave of sell-offs, fuelling bearish sentiment. Next, among macroeconomic indicators, the focus will shift to retail sales, which will be released on Wednesday, the publication of the Beige Book, and speeches by FOMC representatives. All of this comes alongside continued close attention to the ongoing saga of the Fed against the US DoJ.

The FxPro Analyst Team