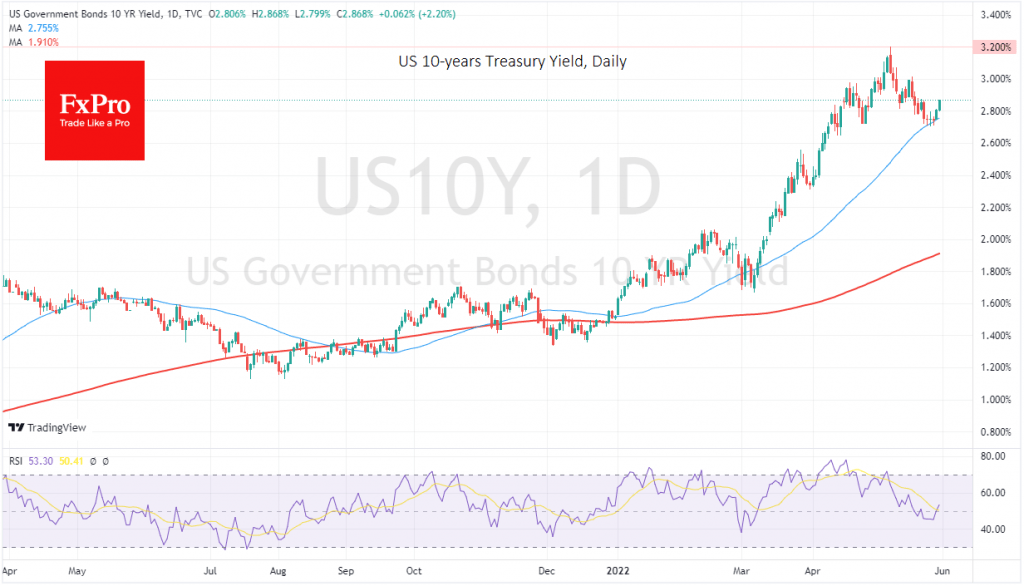

In the US debt market, 10-year Treasury yields have exceeded 2.8% after floundering around 2.7% last week. This small move for bonds is having severe consequences for almost all markets.

The dollar index is almost in sync with long-term bond yields pulling away from its 50-day moving average, coinciding with a 50% correction from the rally from late March to mid-May.

EURUSD and USDJPY are moving today towards the prevailing trends of recent weeks. As in the case of the 10-yr yields and DXY, the dollar bulls went back into play after touching the 50-day averages for these instruments.

US equity index futures are losing traction, with the S&P500 pulling back from levels above 4200 to 4140.

Interestingly, pressure increased in oil, despite a potentially positive backdrop.

The market dynamics on Monday and Tuesday morning may not be indicative as they do not include liquidity from the US. Investors and traders should therefore pay increased attention to Tuesday’s close of trading.

We may well have an answer today as to whether the recent dollar weakening was a bullish respite or the beginning of a downswing.

The FxPro Analyst Team