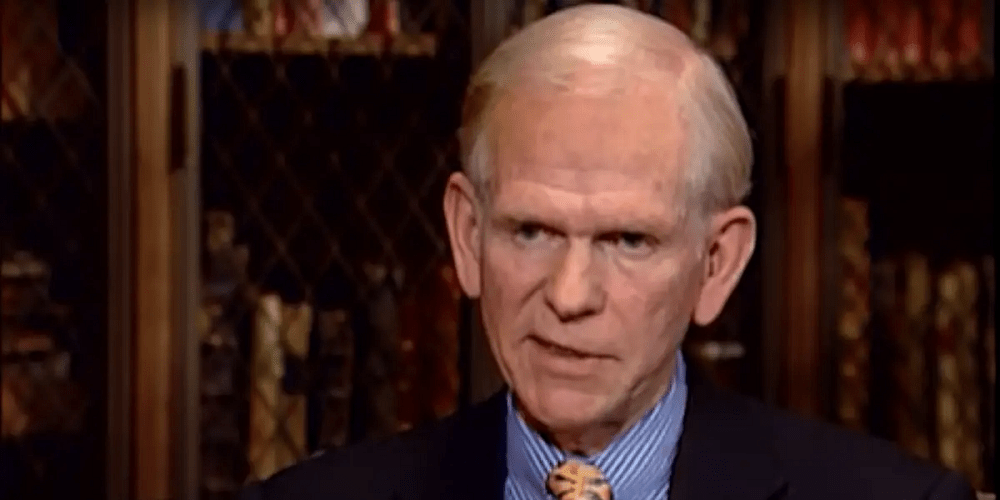

Famed investor Jeremy Grantham on Thursday reiterated his warning that Wall Street is in a bubble as individual traders get “carried away.” “They’re becoming euphoric … They’re borrowing money. They’re trading more shares,” Grantham, co-founder and chief investment strategist at Grantham, Mayo, & van Otterloo told CNBC’s “Squawk Box Asia” on Thursday.

In recent months, Grantham has warned that the massive runs on Wall Street are turning into an “epic bubble.” On Thursday, Grantham pointed to the number of over-the-counter shares traded since last February rocketing to 280 million shares in November and quadrupling to 1.15 trillion shares in December. “We have very seldom seen levels of investor euphoria like this,” he said, referring to individual investor speculation, rather than institutional.

Grantham said individual investors “are throwing their hearts and souls into it and putting all their cash reserves into the market.” He pointed to the recent rally in bitcoin as well as the proliferation of special purpose acquisition companies (SPACs).

Grantham cautioned that there has “never been a great bull market that ended in this kind of bubble that did not decline by at least 50%.” But he said the catalyst that triggers that drop is “much more difficult” to predict. “It’s entitled to go tomorrow if you look at all the signs … As soon as the new president gets settled in, that would be a perfectly good time for the bubble to start deflating,” he said.

Jeremy Grantham says the market is in a bubble with ‘very seldom seen levels of investor euphoria’, CNBC, Jan 21