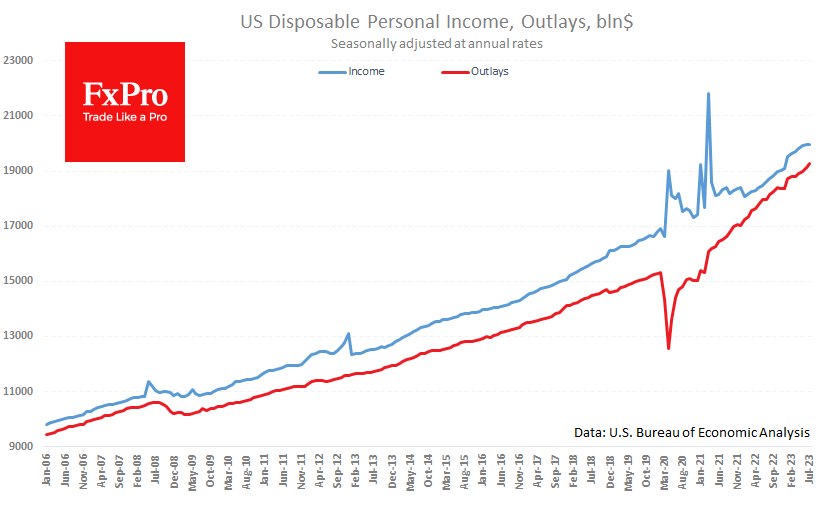

Personal spending by Americans in July points to increased risks of a return to inflation. Consumer spending rose 0.8% in July, following a 0.7% increase a month earlier. Meanwhile, incomes rose 0.2% in July and 0.3% in June. Disposable personal income was unchanged in July after increasing 0.2% a month earlier.

As a result, personal savings fell to 3.5% of income, the lowest since last October, down from 4.7% two months ago.

These are signs of inflationary pressures in the US, contrary to the slump in many commodity prices that fuelled inflation last year. The price index accelerated growth from 3.0% to 3.3% in July. The core index accelerated from 4.1% to 4.2%— a turn upward from double the levels of the Fed’s 2% target.

The conventional wisdom is that stronger-than-expected spending growth is good news for the dollar and (often) the stock market, demonstrating buyer confidence. For the dollar, that rule of thumb remains valid. But it could be bad news for the stocks, pressing down expectations that the Fed Funds rate has already peaked.

The FxPro Analyst Team