Gold has flirted with $2000 three times in the last three years. This time, however, it is more likely that the bulls will soon be able to hold higher for longer, as gold’s rally now has a slightly different character.

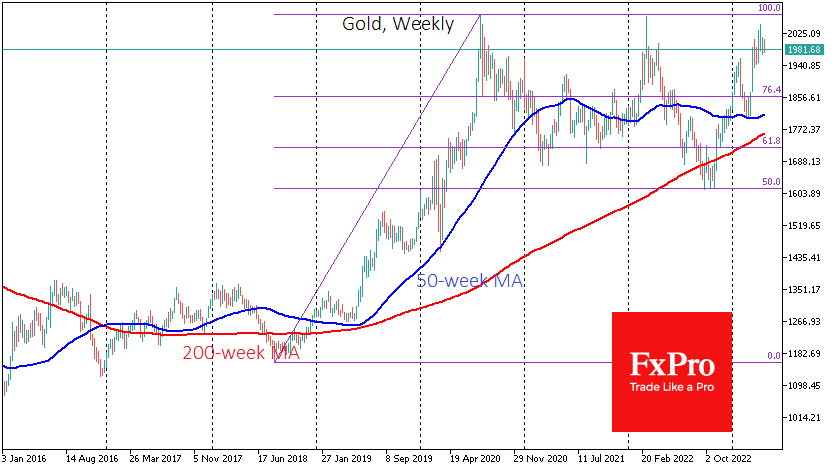

In 2020, interest in gold was an investor response to unprecedented monetary and fiscal easing. When the price reached the psychologically important $2000 level, the gold rally was more than 70% of the cycle low. The rally’s most furious phase began when gold broke through significant resistance at $1800, but the new buying potential was largely exhausted. As a result, the liquidation of short positions that saw gold rewrite its all-time high at $2075 was followed by a prolonged period of profit-taking, despite the continued rally in other risky assets.

In early 2022, gold was in demand, first on fears of capital depreciation and soon after on geopolitics, and we saw a rise of over 15% in less than five weeks. It then failed to make new all-time highs and peaked at $2072. A decisive monetary policy reversal by the Fed and other central banks dragged the price down. Gold bottomed in September-October on signals that the Fed was slowing the rate hikes and that interest rates might soon peak.

We then saw a very rapid return to historical highs – much faster than the other asset classes, which fell in 2022 and bottomed around the same time.

Early last month, we saw a more reliable reason to buy gold – the market’s reaction to the banks’ problems. Gold gained traction as the end of the tightening cycle approached. Moreover, bank problems leading to economic growth issues are a significant reason for the Fed to turn its policy towards easing.

Gold rallied sharply in March, and the market possibly unwound this overheating in the recent 3% correction from the $2048 highs. The sequence of lower highs in 2020, 2022 and 2023 is worrying. But the series of higher local lows over the past five weeks is worth noting. Moreover, all this consolidation is taking place at higher levels than in previous similar episodes, reflecting more interest in buying gold.

The historical tendency for the dollar to weaken at a similar stage in the monetary cycle is also worth considering.

In addition to technical analysis, gold buying is also justified by geopolitics, which remains tense and keeps the idea of a move towards supranational stores of value.

The FxPro Analyst Team