China will likely become the world’s largest economy in a few years and it is preparing itself for major shifts in international trade. In a world rocked by the coronavirus pandemic and tensions with the U.S., the Chinese government has come out with yet another batch of policy terms to bolster its own economy, this time under the vague umbrella of “dual circulation.” The phrase refers broadly to two circles of economic activity — internal and external — with greater emphasis than before on business at home.

The authors used two charts. The first showed an international economy focused on the U.S. as a global demand hub. The second painted a world divided into three parts — Europe, North America and Asia — which would interact with each other on a regional scale. China and its “internal circulation” stood at the center of Asia.

“The ‘dual circulation’ policy demonstrates China’s recognition that it won’t be able to rely on trade as much for the next two decades, as it did for the previous two,” Stephen Olson, research fellow at the nonprofit Hinrich Foundation, said in an email last week. He also noted that: “The pursuit of deep economic integration with China is increasingly seen in the US as a strategic mistake, which worked out extremely well for China, but considerably less well for the US.”

On an individual country basis, the U.S. is still China’s largest destination for exports. But last year, amid escalating trade tensions, North America ceded the spot for top trading partner to the European Union, according to China Customs data accessed through the Wind Information database.

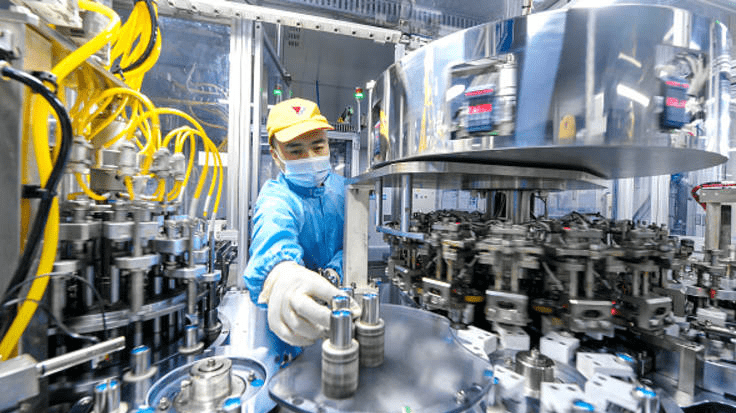

As the Chinese market has grown and the challenges of cross-border trade have increased, more foreign companies are adopting a “in China, for China” strategy. Beijing has welcomed the investment and made significant efforts to keep the businesses in the country despite geopolitical tensions.

In July, China recorded 12.2% growth in foreign direct investment from a year ago to $9.05 billion, according to the Ministry of Commerce. That marked a fourth-straight month of increase since the height of the coronavirus outbreak in early February.

How China is preparing its economy for a future where the U.S. isn’t the center of global demand, CNBC, Sep 01