The U.S. economy looks set to rebound in the current quarter from the previous three months’ deep contraction — but it could sink again if the coronavirus outbreak is not managed well, warned a former Federal Reserve official.

Dennis Lockhart, president of the Atlanta Fed from 2007 to 2017, was among economists and experts who have raised the possibility of a “double-dip” recession in the U.S. economy. A double dip means an economy returning to a period of decline after a brief recovery.

“I continue to believe that looking forward you have to consider a range of scenarios and among those scenarios would be, obviously, a pessimistic one and that could be a double dip,” Lockhart told CNBC’s “Squawk Box Asia” on Friday.

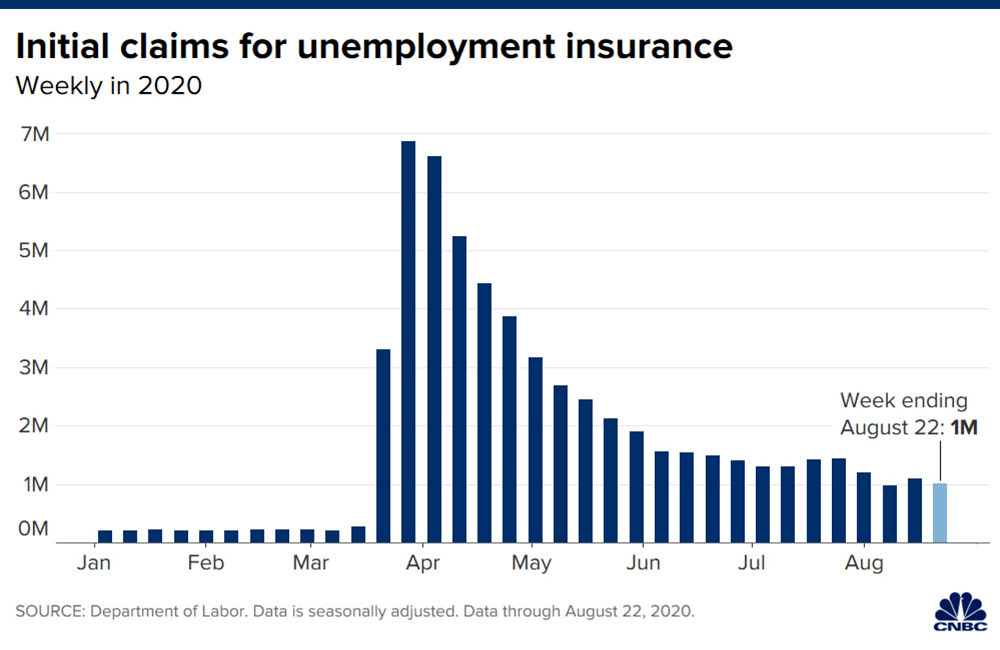

“If things go badly with the management of the virus and there’s more cascading — which (Thursday’s) numbers of initial claims might suggest — then yes, it’s possible we have a double dip. I don’t think that’s probably the base case, but I think it’s still possible.”

He was referring to the initial jobless claims in the U.S., which came in just over 1 million for the week ending August 22, according to the Labor Department. That was the 22nd time that initial jobless claims had come in above the 1 million-mark in 23 weeks.

The U.S. has reported more than 5.8 million confirmed coronavirus cases and over 180,000 deaths — the highest globally, according to data compiled by Johns Hopkins University.

Lockdown measures of varying degrees across the country to contain the outbreak sent the U.S. economy plunging by 31.7% on an annualized basis in the second quarter, said the Commerce Department. That was the country’s worst quarterly fall in gross domestic product on record.

A ‘double dip’ in the U.S. economy is ‘still possible,’ says former Fed official, CNBC, Aug 28