Employment growth of 467K in January was well above forecasts. In addition, there was a noticeable upward revision to the job gains of the previous couple of months. Furthermore, wage growth accelerated to 5.7% y/y, marking the unwinding of the inflationary spiral.

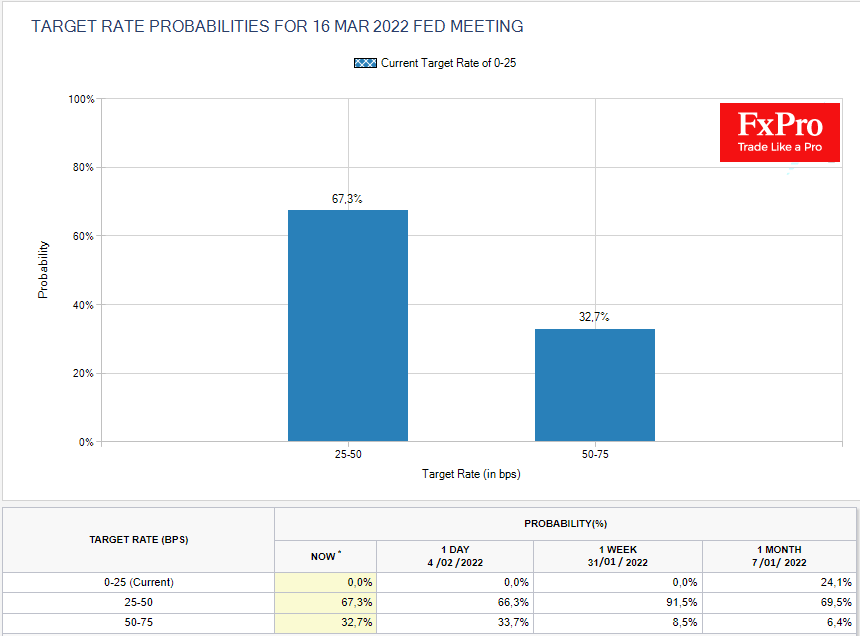

The markets are applying a 33% chance of a 50-point key rate hike by the Fed in March, leaving a 67% chance of a standard move of 25 points. This is a dramatic reassessment of the outlook, as just a month ago, rate futures were leaving a 24% chance that there would be no rate hike in March.

Hawkish comments from Europe and England has added fuel to the fire. Last week, the Bank of England minutes 4 out of 9 MPC members voted for a 50-point rate hike. The ECB is warming to a rate hike this year and potentially twice, although they rejected the idea back in December.

In our view, Friday’s labour market report showed that the US still has a head start on the pace of economic recovery, which will allow for more monetary policy tightening. This is potentially positive news for the dollar, which found ground late last week after correcting by 2.3% from its peak in late January. If the Fed strengthens its signals of willingness to hike the rate by 50 points in mid-March in the coming weeks, it will be grounds for stronger dollar buying.

History suggests that the momentum of the appreciation of the US currency against major competitors is exhausted a few months after a rate hike. Usually, it becomes clear that other central banks have already moved on to the pace of Fed rate hikes and are often even prepared to act more decisively.

But we are not yet in this phase, and the Fed’s policy, as well as the US economic indicators, provide the dollar with a head start for the foreseeable future. As early as February, the dollar index could rewrite the January highs near 97.5 against the current 95.56 and take the DXY into the 100-103 area by mid-year.

The FxPro Analyst Team