Gold added almost 1% on Friday, having managed to defend against a fall below $1900 the day before. The price tests the long-term and medium-term trends for the second month, leaving the Fed to make a decisive argument in favour of the bulls or the bears. Friday’s rise so far looks like a trap for the bears.

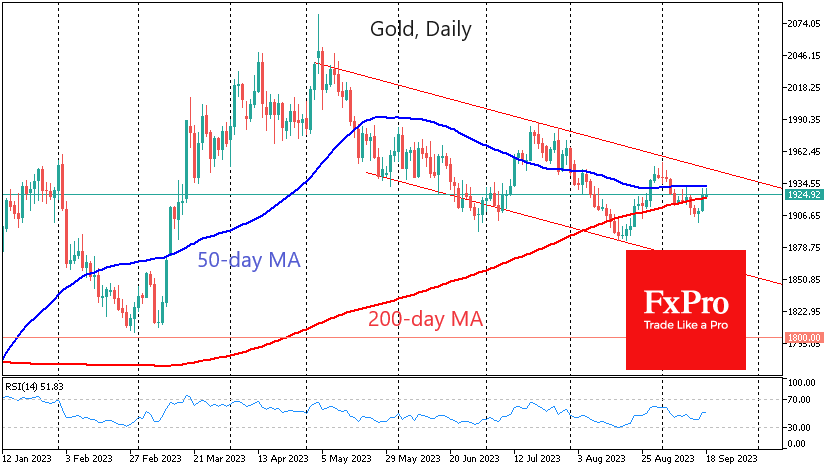

Gold closed last week minimally above its 200-day moving average. In the past two months, this is the second attempt by the bulls to prove that the dip below this line, which acts as a long-term trend indicator, was false, and the long-term uptrend is still in place.

However, this looks more like a temporary revenge, raising the chances of an even more disorganised retreat shortly.

Gold’s performance in August also looks telling. Gold’s dip towards $1890 attracted buyers, but they quickly rushed to take profits on the approach to $1950 and failed to stay above the 50-day moving average for long.

Since May, gold has been in a downtrend with increasingly lower local highs (in May, July, and early September) and declining lows (in June and August).

Gold’s impulsive rebound late last week was counter-intuitive as it coincided with a broad sell-off in equities. However, there is often a direct correlation between these asset classes.

While a temporary balance of power can be seen in the market, we still see more potential for a bearish scenario. However, it has yet to prove its strength.

Thus, confidence in further declines will increase if gold returns under the 200-day moving average at $1922. In this case, we should expect a short-term decline under the previous lows at $1890 with a potential downside at $1850, the lower boundary of the descending channel formed.

Alternatively, if gold consolidates above $1930 and gains strength further above the 50-day moving average, it will make us consider a trend change to an uptrend.

In all cases, the market may give false signals until Wednesday evening, when we will see the market reaction to the Fed’s rate comments. The upcoming meeting has the potential to reverse the current short-term picture.

The FxPro Analyst Team