Today the central banks of Canada and New Zealand raised their key rates by 50 points at once. New Zealand was not expected to rise sharply, but that did not save the NZD from the ensuing sell-off.

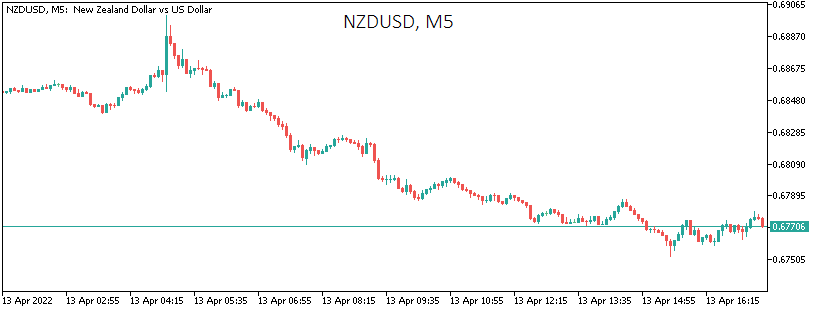

A heavy downturn followed a predictable initial surge of 0.5%. The NZDUSD lost 2% from its intraday peak, pulling back to 0.6760.

Minutes ago, the Bank of Canada raised its rate by 50 points to 1.0% and announced the start of quantitative tightening from the end of April. But once again, we did not see CAD strengthening: after sharp swings right after the announcement, USDCAD remains near its highest levels since March 17th.

Judging by the reaction, the market is betting that the Fed will act even more aggressively by raising the rate by 50 points and announcing the start of active selling of securities from the balance sheet. On Thursday, there will be an ECB meeting from which no active rate action should be expected. By that logic, the euro is on the edge of a precipice, and the central bank might not have the strength to keep the euro from falling into it.

The FxPro Analyst Team