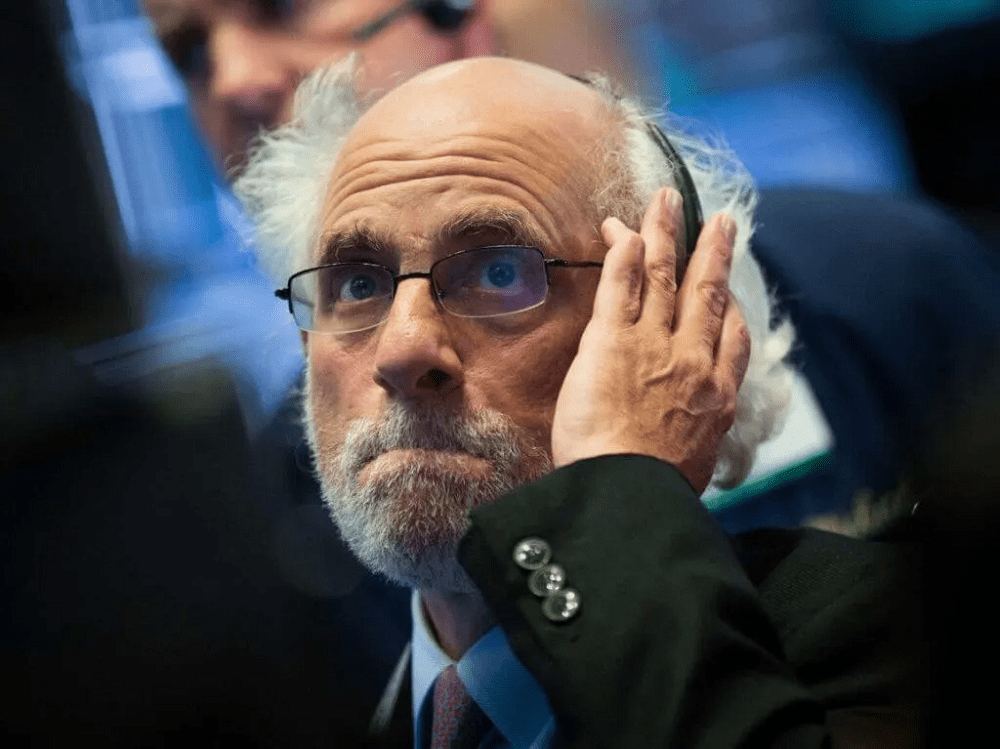

With Donald Trump’s health still a big question mark among investors, many wonder if we’ll close out the year with another big stock market crash. Volatility is all-but-certain in the near-term amid Covid-19 and the presidential elections. Market bulls are using this uncertainty to bet on a return to normalcy and take up long-term positions. Still, some analysts say the market outlook is rocky even beyond the pandemic.

According to University of Utah Finance Professor Matthew Ringgenberg, a recent rise in the number of short positions in the market should give investors pause. He claims that his short-selling activity index is one of the most accurate indicators of the stock market’s long-term direction.

Ringgenberg’s data show that short selling activity is approaching pre-pandemic levels. That’s significant because before Covid was a factor, traders were expecting the stock market to trend downwards. At the top of the pre-pandemic bull market, Riggenberg’s index of short-selling index read 1.28. Today it’s back up to 1.26. The short-selling activity indicates that 12 months from now, the stock market will be lower than it is today.

Ringgenberg isn’t the only one sounding the alarm about a stock market crash. Morgan Creek Capital Management CIO Mark Yusko is similarly skeptical about the market’s long-term direction. He believes the stock market could be heading for a 70% drop as irrational exuberance among investors and ultra-high debt levels threaten to topple Wall Street’s house of cards.

70% Stock Market Plunge Could Be Brewing: Analyst, CCN, Oct 5