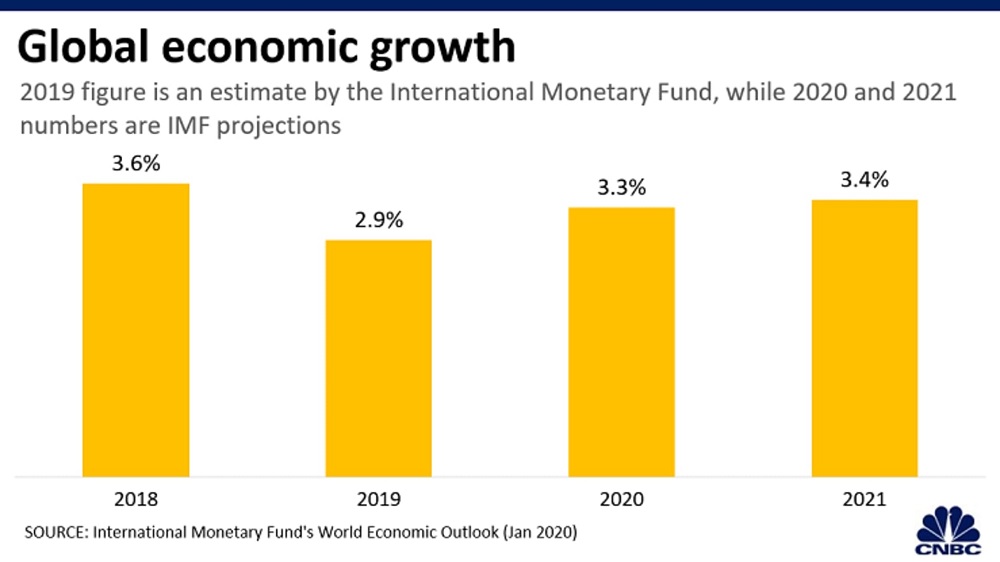

The International Monetary Fund on Monday released its latest projections for the global economy. Here are five charts that show the fund’s latest assessments of the world economy.

Global recovery

The IMF has forecast the global economy to rebound to 3.3% this year from an estimated 2.9% last year. However, that projection for 2020 is a downward revision from 3.4% stated in its October 2019 World Economic Outlook.

India’s growth markdown

India, Asia’s third-largest economy, is expected to grow by 5.8% in 2020 — a 1.2 percentage point markdown from the organization’s October forecast.

China’s upgrade

China’s growth forecast for 2020 was revised higher by 0.2 percentage points to 6.0%, according to the IMF. That’s partly because the country’s “phase one” trade deal with the U.S. is likely to reduce some risks facing the world’s second-largest economy, the fund said.

US growth moderation

The U.S., the world’s largest economy, is projected to grow by 2.0% this year — a downward revision of 0.1 percentage points compared to the IMF’s October forecast.

Euro area pick up

Growth in the euro area for this year was revised down by 0.1 percentage points to 1.3%, according to the IMF. These are the IMF’s growth forecasts for major European economies this year:

Germany: 1.1%

France: 1.3%

Italy: 0.5%

Spain: 1.6%