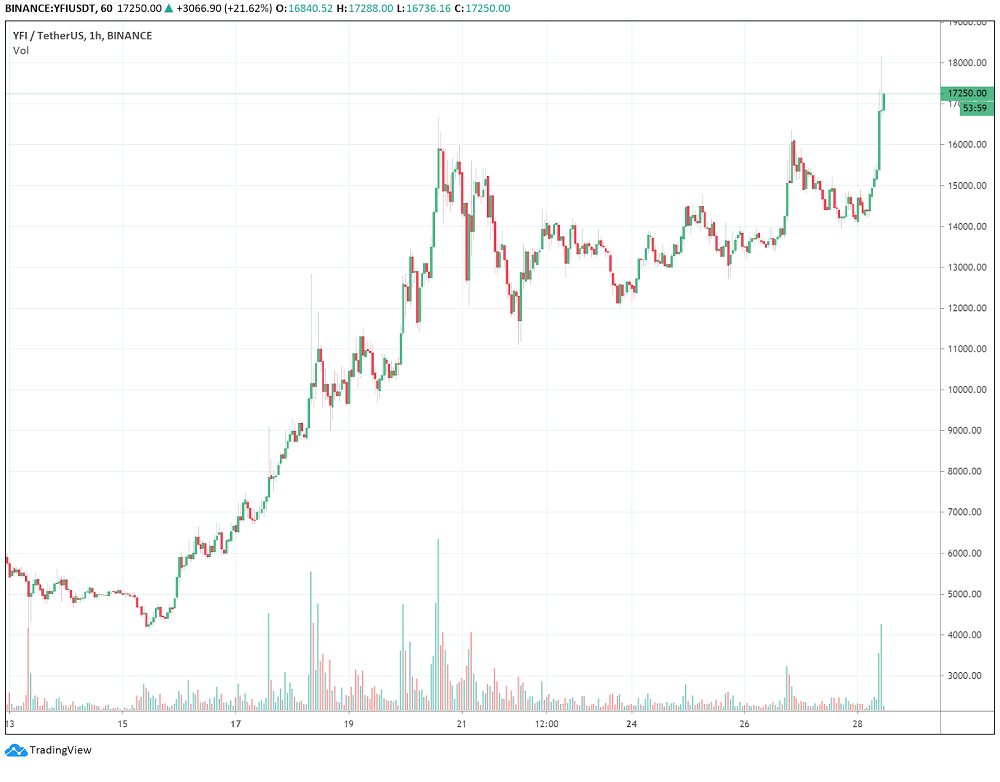

YFI, the native token of the Decentralized Finance (DeFi) giant yearn.finance, achieved a new all-time high. It soared by 30% in the last 12 hours from $14,017 to $18,169, entering price discovery. The term price discovery refers to when an asset hits a new record high and markets seek a new peak. YFI entered price discovery for the first time in 8 days, after achieving its previous peak at $16,666.

Three factors likely triggered the rally of YFI to a new all-time high: a potentially new partnership, a listing on Aave, and strong technicals. On Aug. 28, the money market protocol Aave (LEND) listed YFI. Aave is the largest DeFi protocol in the global market with more than $1.52 billion in total value locked.

As Cointelegraph previously reported, Aave received approval from the U.K. Financial Conduct Authority, which further secured the dominance of Aave over the DeFi market. Jordan Lazaro Gustave, the COO of Aave, told Cointelegraph:

“Aave will also be making credit delegation possible, where party A can delegate their credit line to party B, who can borrow against it. This will all be made possible by a legal agreement via OpenLaw. For example, a credit delegator could be a party that wants to build up more credit, and a borrower could be a business, NGO, government, institution, etc.”

Although yearn.finance has been a major DeFi protocol with nearly a billion dollars in value locked, Aave listing could further boost the momentum of YFI. Atop the new listing, yearn.finance developer Andre Cronje said he is collaborating with FTX CEO Sam Bankman-Fried.

FTX, one of the top cryptocurrency derivatives exchanges, has been leading various partnerships in recent weeks. It backed the launch of a decentralized exchange (DEX) called Serum and acquired Blockfolio. A potential collaboration between FTX and yearn.finance developer Cronje goes in line with FTX’s activity in the DeFi and DEX market.

3 reasons why Yearn.finance YFI price just hit a new high of $18K, CoinTelegraph, Aug 28