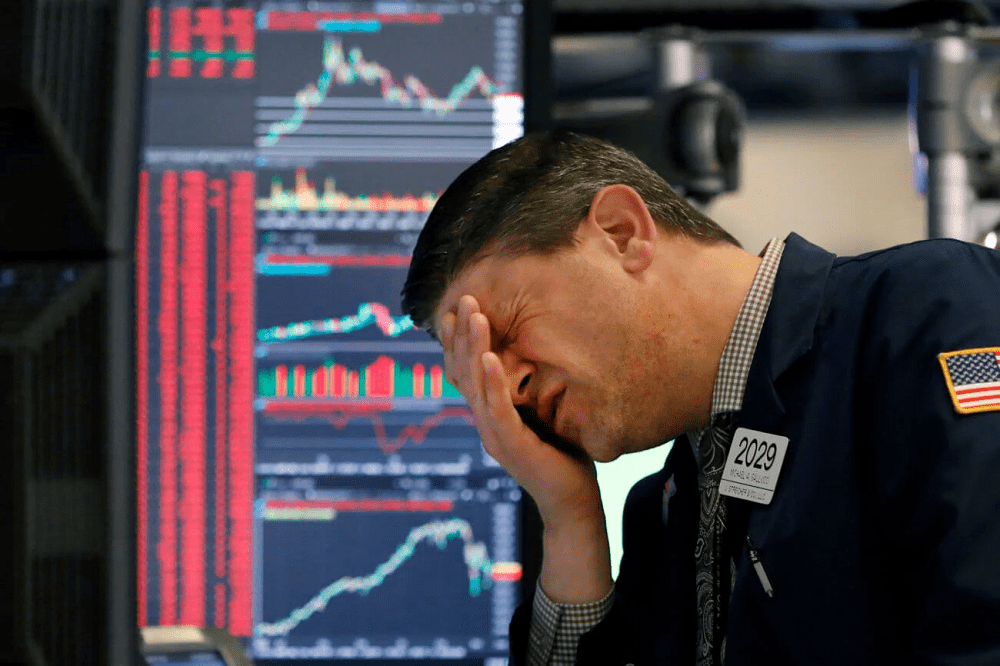

Three key data points in growth, jobs, and spending indicate the ongoing stock market rally will be short-lived. Strategists are revising the expected growth of the U.S. economy and jobs market once again, unnerving investors.

The Dow Jones Industrial Average (DJIA) surged by 2.21% on May 27 and has recovered to early March levels. Japan’s Nikkei 225 increased by 2.32% in the same period, affected by the performance of the U.S. stock market and its $2 trillion stimulus package.

1: Revised Economic Growth

According to Bloomberg Economics, the global economy is expected to contract by -4% in 2020. In March, the researchers predicted the economy to shrink by -0.2% and in January, the forecast was hovering at a 3.3% gain.

Supply chains are disrupted, geopolitical risks are mounting, the pandemic still remains a real threat, and companies are struggling to meet their guidance.

2: Rising Unemployment Claims

The U.S. stock market has been increasing despite a significant spike in unemployment claims.

Economists predict that the U.S. is on track to reach 41 million jobless claims within the next 10 weeks.

U.S. President Donald Trump is pushing to reopen the economy by the month’s end, and that led to optimism towards a lower unemployment rate in the near-term.

But, researchers at Bank of America (BofA) emphasized that the process to reintroduce millions of people back into the workforce will be gradual.

3: Declining Consumer Spending

The Consumer Comfort Index fell from 65 to nearly 35 year-over-year from April 2019 to April 2020.

The data suggests the general population in the U.S. are simply not willing to spend their money on leisure, travel, and casual purchases.

The stock market is seemingly dismissing the worrying consumer trend shift in the U.S. But, in the medium-term, it could affect a wide range of key industries including finance (credit card companies), retail, travel, and real estate.

It goes in line with studies that found households are saving at a rate unseen since the 1980s. Households are becoming more frugal, reducing costs and tightening their budget.

3 Gloomy Metrics Threatening an Abrupt End to the Stock Market Rally, CCN, May 28