Global Debt Crisis

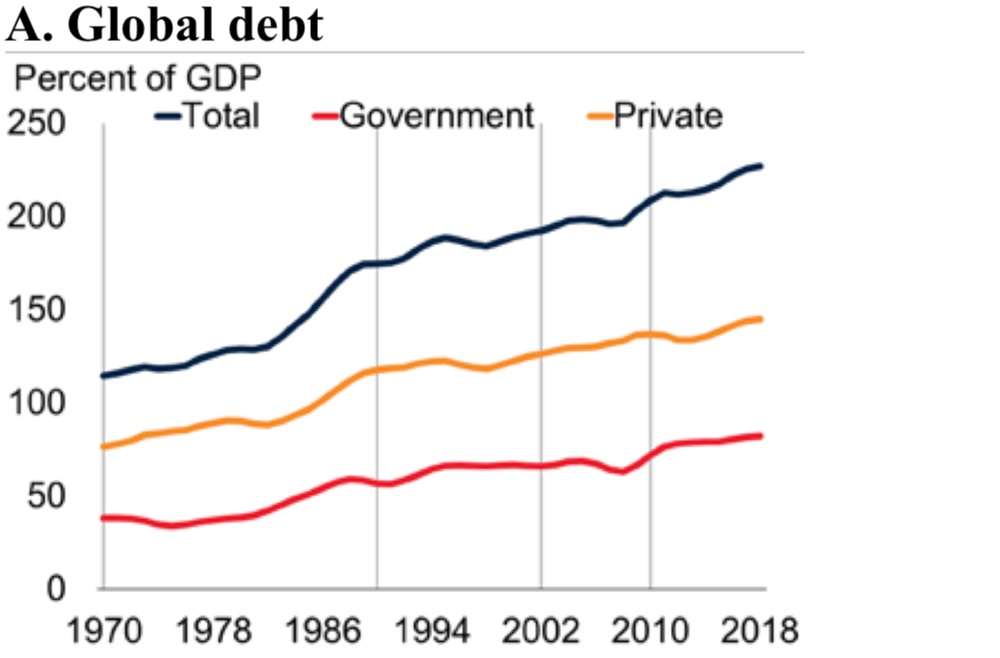

Famed investor and co-founder of the Quantum Fund and Soros Fund Management Jim Rogers says that when the bear comes, it’s going to be a grizzly. He believes that the next bear market will be the worst he’s ever seen. Sky-high debt, he says, is the reason for his pessimism. In 2008 we had a problem because of too much debt. Since then the debt everywhere in the world has skyrocketed. The Federal Reserve, the central bank in the US increased its balance sheet by 500% in 10 years. That alone is an unbelievable statement.

Investors Are Overestimating US Stock Market Optimism

Another warning that a stock market crash could be around the corner came from Deutsche Bank’s Parag Thatte, Srineel Jalagani and Binky Chadha on Friday. They cautioned that, Equity positioning, like the market itself, has run far ahead of current growth as investors price in a global growth rebound.

Geopolitical Tension

The geopolitical tension hanging over the US stock market can’t be overlooked in 2020. The most obvious disruptor is the conflict with Iran, despite the fact that investors had largely shrugged it off by the end of last week. This weekend Iran took responsibility for shooting down a Ukrainian passenger plane, a development that will surely escalate the conflict within the region. This kind of incremental rise in tension is likely just the beginning. At some point, investors may start to get nervous resulting in a mass-exodus.