Taiwan’s outsized role in chipmaking has come under the spotlight as a global shortage of semiconductors forced several automakers to halt production. Countries including the U.S. and Germany reached out to Taiwan to help alleviate bottlenecks in the production of chips. The shortage was a result of increased demand for electronics during the Covid-19 pandemic, and was exacerbated by former President Donald Trump’s trade war with China.

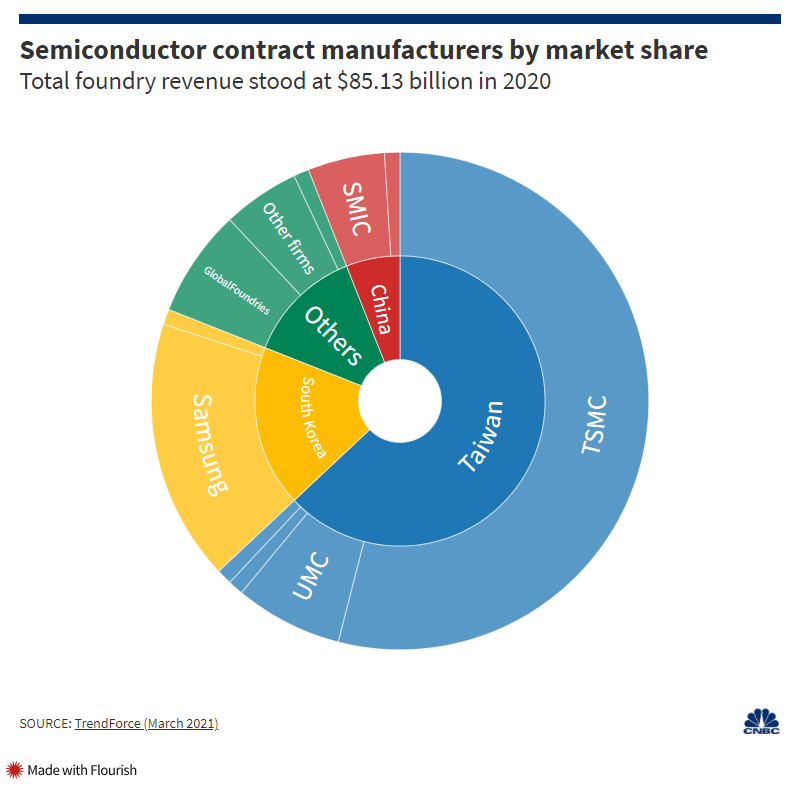

Taiwan dominates the foundry market, or the outsourcing of semiconductor manufacturing. Its contract manufacturers together accounted for more than 60% of total global foundry revenue last year, according to data by Taipei-based research firm TrendForce. Much of Taiwan’s dominance can be attributed to Taiwan Semiconductor Manufacturing Co or TSMC, the world’s largest foundry that counts major technology firms such as Apple, Qualcomm and Nvidia as its clients. TSMC accounted for 54% of total foundry revenue globally last year, TrendForce data showed.

Semiconductors are critical components that power electronics from computers and smartphones to the brake sensors in cars. The production of chips involves a complex network of firms that design or make them, as well as those that supply the technology, materials and machinery to do so. TSMC focuses solely on manufacturing and has been the go-to producer for many cutting-edge semiconductors, Dan Wang, a technology analyst at research firm Gavekal, said in a podcast by Singapore’s DBS bank. Semiconductor designers and manufacturers are on a quest to make chips smaller and better. Currently, TSMC and its South Korean rival Samsung are the only foundries capable of manufacturing the most advanced 5-nanometer chips. TSMC is already gearing up for the next-generation 3-nanometer chips, that will reportedly start production in 2022.

2 charts show how much the world depends on Taiwan for semiconductors, CNBC, Mar 16