As Bitcoin (BTC) blasted through the $14,000 level its market capitalization surpassed the monetary base of the Russian ruble. This measure includes both physical currency and bank reserves, both of which are usually held by a country’s central banks.

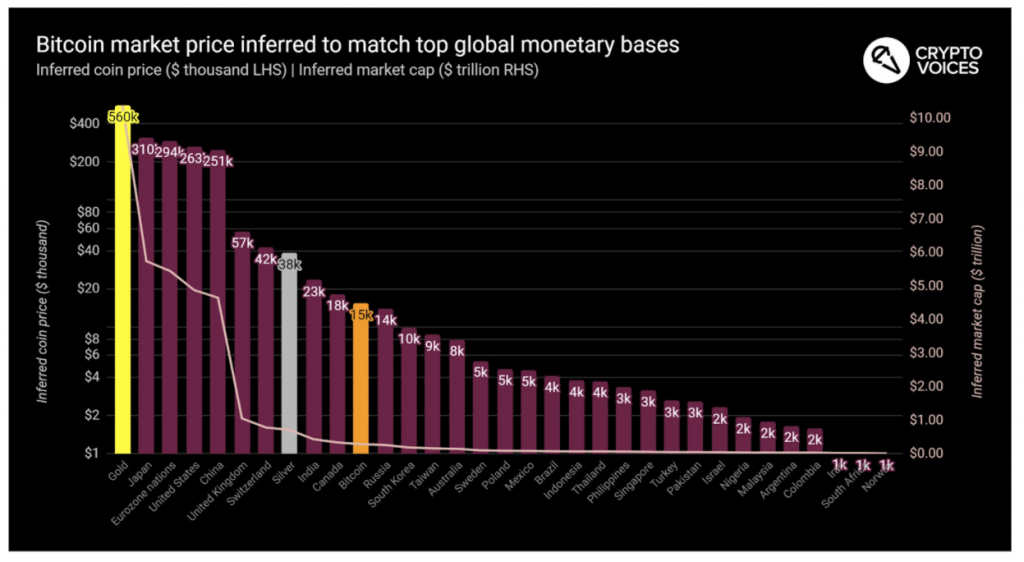

The above chart may seem complicated at first glance, but it simply compares gold, silver, Bitcoin, and the remaining global monetary bases. We can see that the U.S. has $4.9 trillion physical notes, coins, and bank deposits parked at the Federal Reserve. By dividing this number by the current 18.5 million outstanding BTC, we reach the $263K stated above.

In order for Bitcoin’s market capitalization to match the U.S. base money figure, the price would need to surpass $263,000. Although this might seem far-fetched, BTC has already eclipsed multiple sovereign currencies like the Brazilian real, the Swedish krona, and the South Korean won.

This move is no small feat for a cryptocurrency that is only 11 years old. According to Fernando Ulrich, the economist behind Crypto Voices, the top 30 base money competitors cover 95% of GDP. Aside from the Euro covering many countries, some of the top 113 peg their currencies to the U.S. dollar.

The ruble has fallen, as have many other sovereign currencies so now all eyes are on the Canadian dollar. As shown in the fiat base money supply chart, the Canadian dollar’s base money stands at $335 billion which is equivalent to an $18,000 Bitcoin price.

$18K Bitcoin price, eh? BTC market cap may pass Canada’s monetary base, CoinTelegraph, Nov 10