Bitcoin fell 4.8% on Wednesday, ending the day around $37.0K. Ethereum lost 3.9%, while other top-ten altcoins fell between 4.4% (Cardano and Polkadot) and 7.8% (Solana and Terra).

The total capitalisation of the crypto market, according to CoinGecko, overnight fell by 3.4% to $1.8 trillion, while Bitcoin’s dominance index fell 0.2% to 39.2%.

Bitcoin began a sharp decline on Wednesday as the US session opened, along with US stock index futures. After several hours of falling, stock indices reversed and regained momentum. BTC, meanwhile, broke its previous strong correlation with equity indices and did not show a meaningful rebound.

The benchmark cryptocurrency came under pressure from reports of a severe snowstorm coming to Texas. A year ago, a similar weather anomaly disrupted the power supply to a quarter of households and caused loss of life, forcing authorities to impose a state of emergency.

The state’s association of miners, the Texas Blockchain Council, decided to de-energise mining farms on Wednesday.

Texas is home to the main bitcoin network computing capacity in the US. The states themselves are the world’s number one miner of the significant digital asset (around 49% of hash rate).

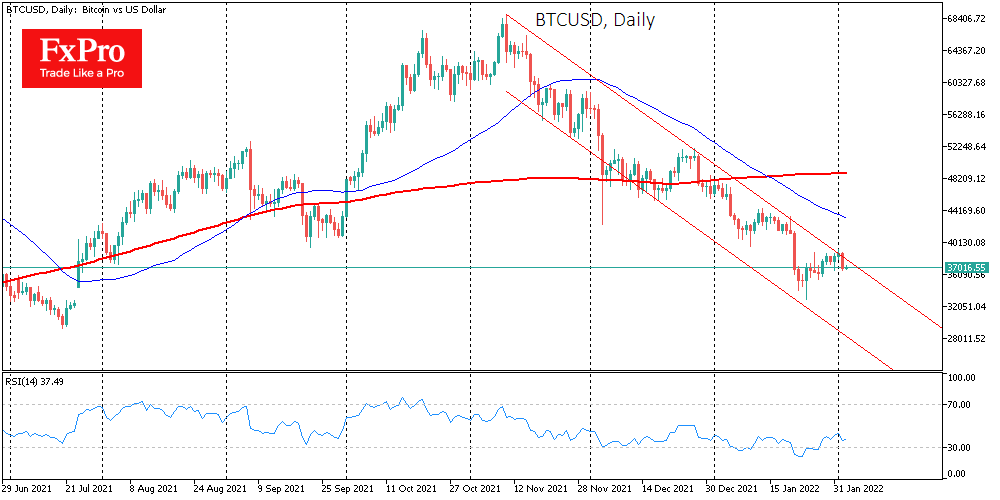

Bitcoin again proved that it remains in a downward channel, as the recovery bounce lost strength at the upper end of the range. In theory, a bearish reversal of bitcoin opens the possibility of updating the January lows with potential targets near 30K.

The FxPro Analyst Team