Market Picture

A second wave of liquidation of long positions hit the crypto world on Monday afternoon. Total capitalisation rolled back to $1.53 trillion at the low point against $1.66 trillion on Saturday.

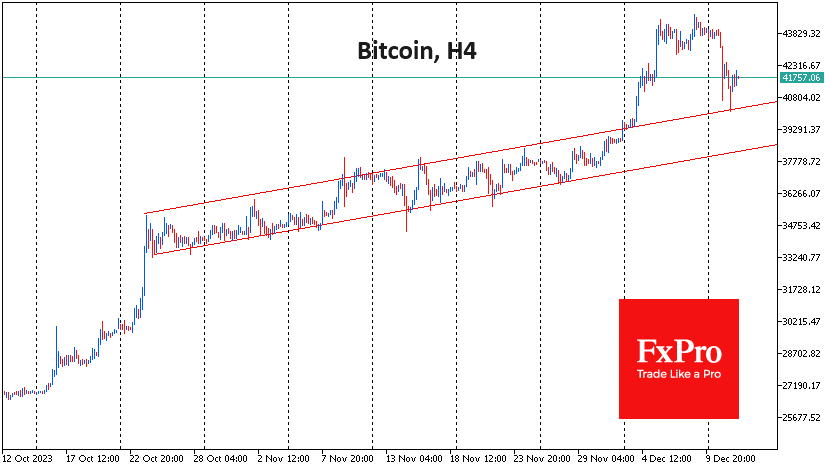

At the low point of the sell-off, Bitcoin’s price was down to $40.1K, nearly nullifying the gains of the previous seven days and touching the former upper boundary of resistance of the two-month trading range. Bitcoin’s decline on 11 December was the highest in nine months.

Thus, bitcoin erased the results of last week’s acceleration but is still formally clinging to a more global upward trend.

The dynamics of the first cryptocurrency diverge dramatically from what we see in the US and eurozone equity indices. But the big question is, is Bitcoin the canary in the coal mine? A reversal after an acceleration could be a leading signal of a shift in risk appetite. Then, the flight to defensive securities will spread to the equity market very soon.

News Background

According to CoinShares, crypto fund investments rose by $43 million last week; inflows continued for the 11th consecutive week. Bitcoin investments increased by $20 million, Ethereum by $10 million, and Solana by $3 million.

Investments in crypto funds declined markedly from previous weeks. Recent price increases have also led to a significant influx of short BTC positions, as some investors see the potential for a corrective decline.

The issuer of the largest USDT stablecoin, Tether, announced a voluntary cooperation with US authorities: the company will block wallets associated with people and organisations under sanctions in its smart contract. Tether blocked 161 addresses from OFAC’s SDN list. Of those, 150 turned out to be empty.

The US SEC will continue legal proceedings with Binance despite the company’s agreement with the Department of Justice, Bloomberg writes, citing its sources.

Former SEC attorney John Reed Stark compared the series of claims against Binance by US government agencies to a crushing tsunami killing the cryptocurrency platform’s business.

The FxPro Analyst Team