Market picture

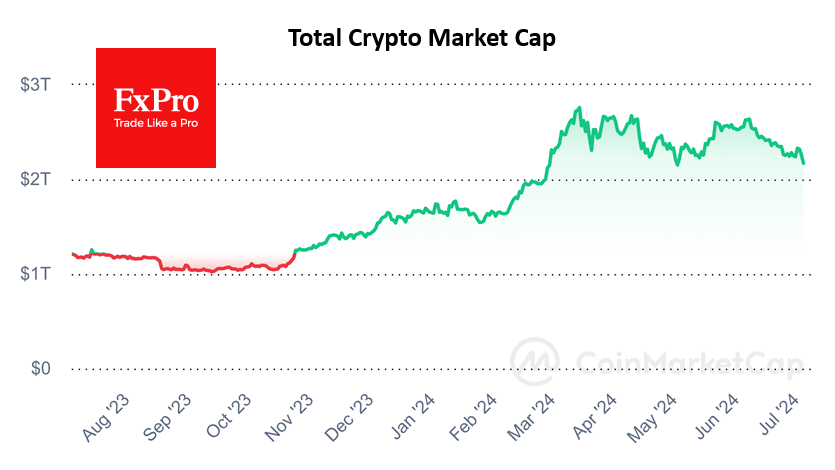

The crypto market plunged 3.6% in 24 hours to $2.17 trillion, its lowest level since late February. Triggered stop orders in this morning’s thinly liquid market added to the magnitude of the decline, sending Bitcoin briefly below $57.7K and Ethereum to $3150. Top altcoins are losing in a range from -0.7% (Tron) to -9% (Solana).

Bitcoin has lost 9.5% in just over two days of selling. At its low point on Thursday morning, the price touched the lower boundary of the descending channel and dropped below the 200-day moving average but has so far been able to bounce back above it, trying to stay within established patterns. However, this has not been entirely successful, as the price is already below the 61.8% retracement level and has updated the lows from early May. From the current position, a 12% drop to $51.5k (February consolidation area) is more likely than the same amount of growth to $65.8k (50-day MA).

Solana underwent an intensified sell-off after touching the 50-day MA and is now testing support at the 200-day MA. As with Bitcoin, a break below would force the pair to target the late February lows as a potential next stop.

News background

Despite the correction, the options market is still heavily skewed towards BTC growth, as evidenced by the strong interest in long-term options at the $100,000-120,000 strike. According to QCP Capital, this points to the likelihood of a resumption of the rally by the end of the year.

According to River, by the end of the first quarter, 13 of the top 25 US hedge funds had invested in spot bitcoin ETFs. According to the research, 534 organisations—from hedge funds to pension and insurance companies—with more than $1bn in assets have invested in BTC ETFs. Specifically, 11 of the top 25 registered investment advisers and hundreds of smaller firms have placed money in the instrument.

VanEck said the launch of the Solana ETF is largely dependent on the outcome of the upcoming US presidential election and whether Gary Gensler remains at the helm of the SEC. The firm filed to launch such an ETF last week.

Nate Geraci, president of investment firm The ETF Store, suggested that the final Form S-1 filing could be approved by 12 July, opening the way for the Ethereum ETF launch on 15 July.

Despite the ban on cryptocurrency mining in the PRC, Chinese bitcoin mining pools hold 54% of the market share, said CryptoQuant CEO Ki Yun Ju. He suggested that the government could control several cryptocurrency mining pools.

Pump.fun, a Solana-based meme token launch platform, has surpassed Ethereum in terms of daily revenue, reaching $1.99 million. According to Dune Analytics, the platform issued an additional 11,528 tokens on 1 July, bringing its cumulative total to 1,199,685.

The FxPro Analyst Team