Market picture

The capitalisation of the crypto market over the past 24 hours has added only 0.15% to $2.44 trillion. Crypto sentiment indices remain in the ‘greed’ territory, scoring 71 points, compared to 73 points the day before.

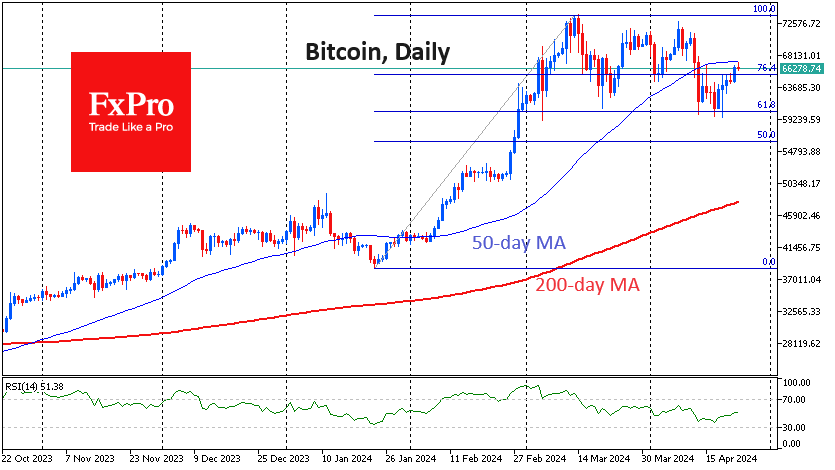

Bitcoin added about a quarter of a percent during the day, reaching $66.5K. Early on Tuesday morning, the price briefly exceeded $67.1K, touching the 50-day MA, but then retreated. It seems that this time, the crypto market is waiting for a signal from stock indices rather than giving such a signal about risk appetite. The calm may be illusory and quickly come to an end. We reiterate that consolidation above $67.1K could open the way to the $72-74K area. A reversal to the downside could end with a quick rollback to the $60K area.

According to CoinShares, investments in crypto funds over the past week have decreased by $206 million after an outflow of $126 million the previous week. Investments in Bitcoin decreased by $192 million, in Ethereum – by $34 million, in Solana – by $0.3 million.

News background

There was a further outflow of capital from the Grayscale fund totalling $450 million, which could not be compensated by the inflow into the two largest ETFs totalling $259 million. Investors’ appetite for ETFs is declining, probably due to overall pressure on stock markets due to changing expectations for Fed policy and a strengthening dollar.

The average transaction fee in the Bitcoin network has dropped to $34.86 after reaching a record $128.45 on the day of the halving on April 20. The growth of transaction fees began on the eve of the halving. Experts linked the trend with user activity in anticipation of the launch of the Runes protocol, which was timed to coincide with the event.

The Bitcoin Initiative group of Bitcoin supporters has initiated a referendum to amend the Swiss constitution. The group intends to oblige the Swiss National Bank (SNB) to include BTC along with gold in its reserves.

FTX management will get rid of a new batch of the bankrupt exchange Solana (SOL) in the form of an auction after criticism from creditors, said Figure Markets CEO Mike Cagney.

The FxPro Analyst Team